-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

MetaTrader4 Brokers

The top MT4 brokers

-

MetaTrader5 Brokers

The top MT5 brokers

-

cTrader Brokers

The top cTrader brokers

-

TradingView Brokers

The top TradingView brokers

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

What should be a slow Monday morning given the bank holidays in the US and UK was made a little more interesting by news of a deal between Biden and Republican congressional leaders on increasing the US debt ceiling. The agreement raises the debt ceiling until 2025 and sets limits on non-defence spending for the next two years.

While the threat of a US default has lessened, the deal still needs to be passed by legislators, with some Republican lawmakers already making it clear that they will not vote for it. This will be the first major test of Republican House Speaker Kevin McCarthy’s authority following a bruising battle with the right-wing members of his party in January. Both sides are sounding confident that the deal will pass, but any serious threat of a revolt by Republican House members will send markets immediately back to a risk-on footing.

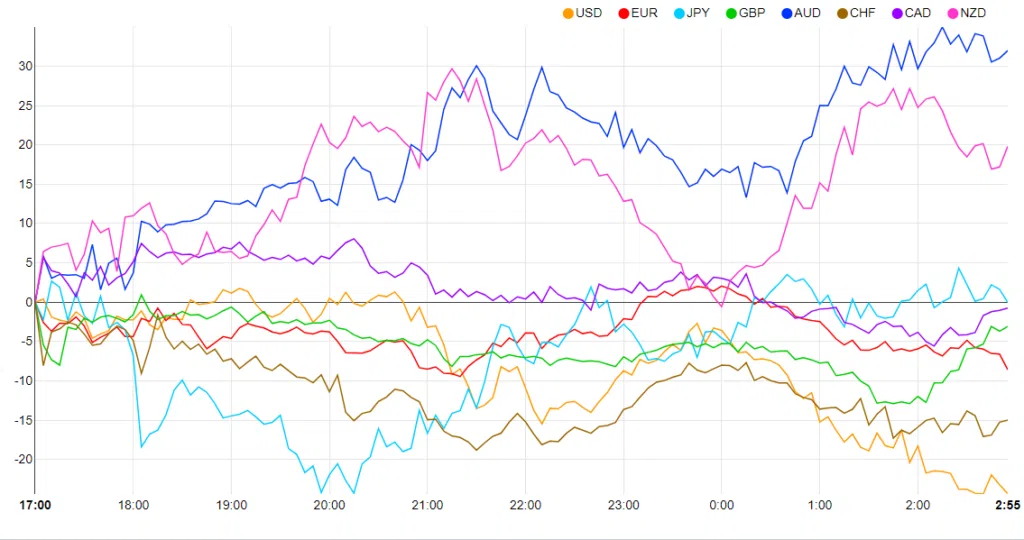

But markets remain relatively quiet. With the US default looking less likely, traders are pulling out of the USD and beginning to look further ahead. Most major currencies were clawing back some of the losses they have made over the past few weeks, with the AUD the best performer so far.

It’s a quiet week for Europe, but employment data, in the guise of the US Non-Farm Payroll, will be released on Friday and carefully scrutinised by traders looking to predict the Federal Reserve’s next move.

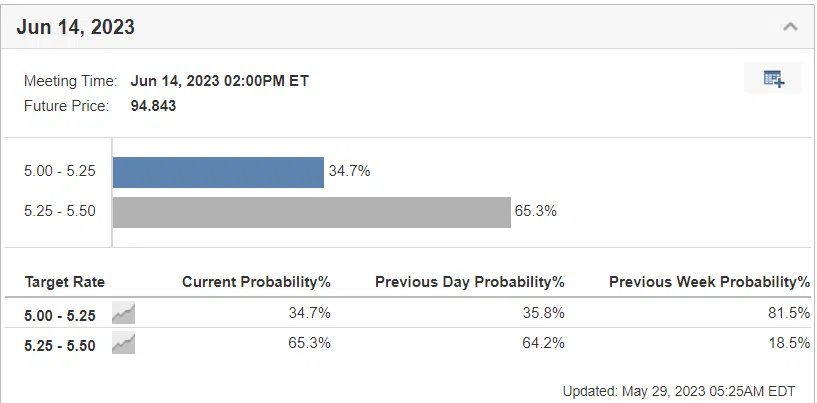

We saw a hawkish rebalancing of the probabilities of the June interest decision last week, with a 2bps rise now priced in at over 60%.

This is a big shift from market expectations over the last month, with most analysts predicting a pause. But a raft of recent data has shown that the US economy is still powering ahead, with consumer spending surging by 0.8% last month, despite monetary tightening.

So, while we may see further USD weakness over the next few days, fundamentals may change rapidly from the end of the week, with a strong NFP result likely to lead to a resurgence in USD demand.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.