Islamic Forex accounts will not charge interest on open positions held overnight.

Across the Islamic world, many brokers offer Shari’ah-compliant accounts to make sure that your trading is not haram – though this does mean that there are a few differences when compared to traditional Forex accounts.

Islamic Forex accounts have two underlying attributes:

- Free swap rates

- No interest rate payments – or no Riba.

Other than the above, Islamic Forex accounts usually have the same trading terms and conditions as regular Forex accounts. However, some most Forex brokers change the commercial terms of trading with them and might limit the trader from trading cryptocurrencies.

Some Forex brokers will widen their spreads on Islamic accounts to compensate for the missed revenue that would otherwise have been generated by collecting interest. Another practice, but is far rarer, is that some Forex brokers charge an up-front commission on trades instead of widening the spreads.

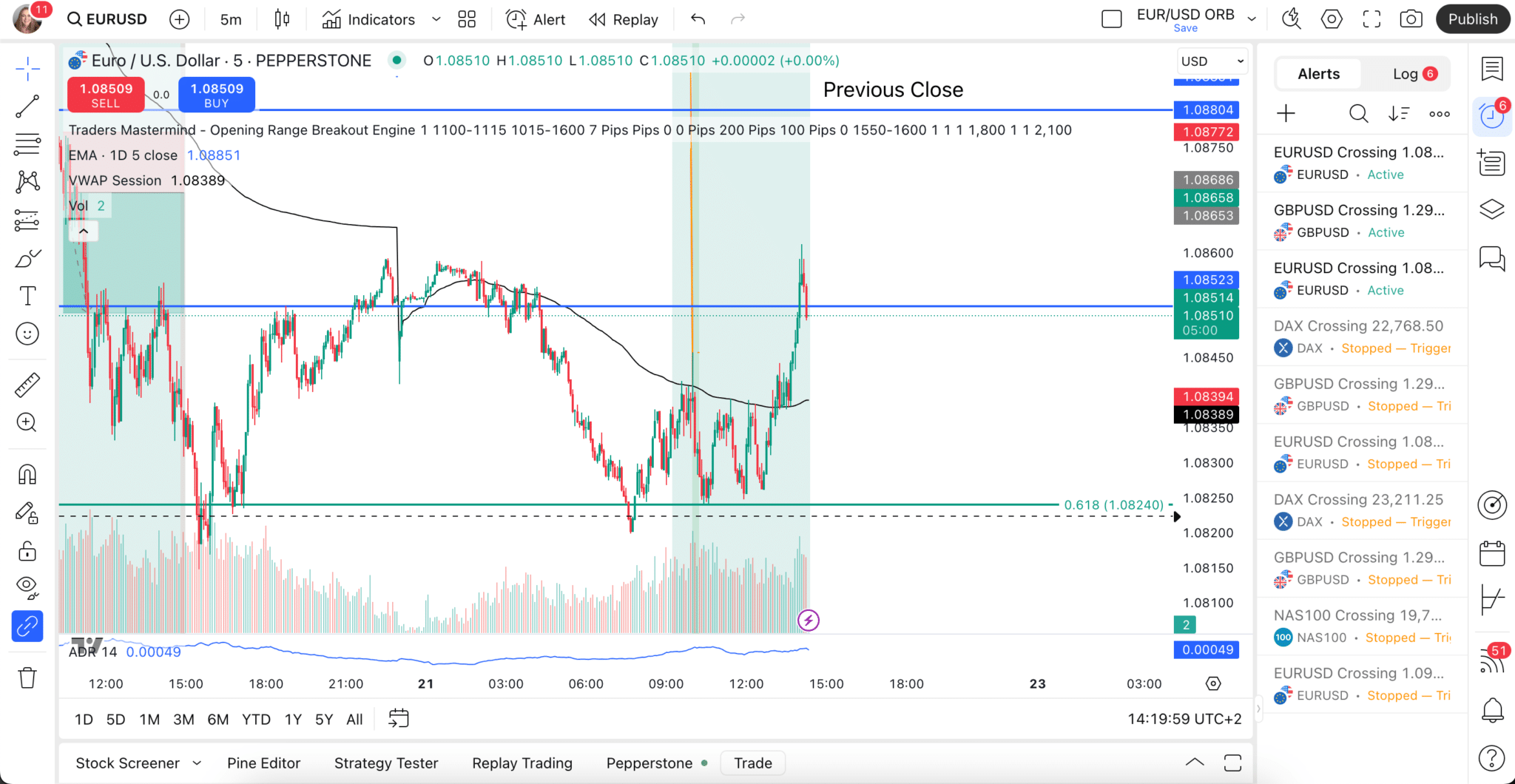

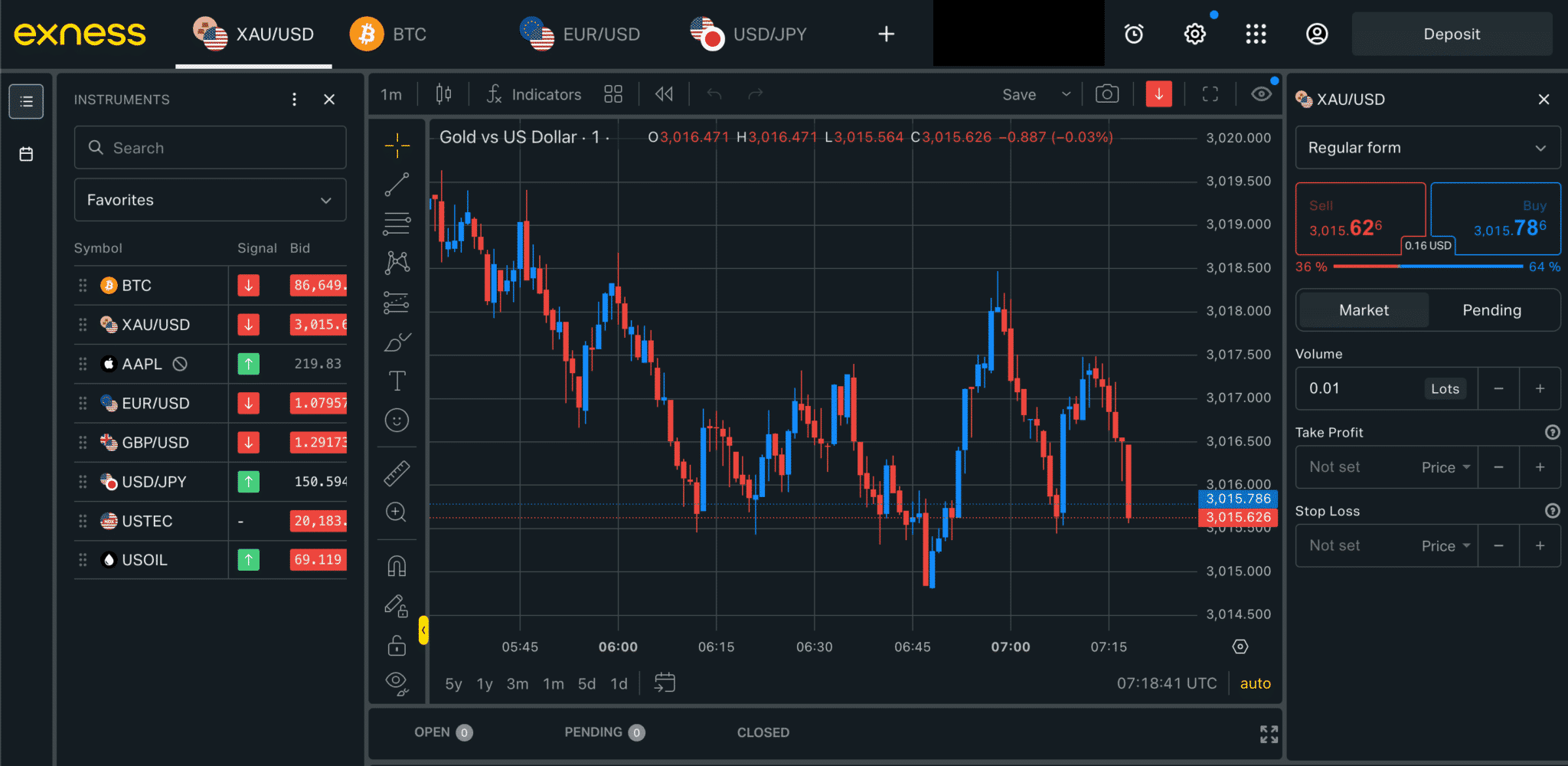

Forex Brokers with Islamic Swap-free Accounts

There are a variety of brokers that offer Islamic accounts tailored for Muslim traders. This account type usually has no limitations, which means you can trade Forex, commodities, CFDs contracts, and every financial instrument that complies with Islamic financial regulations.

An important note: With most Forex brokers, you must open a real trading account, which can then be converted into an Islamic account. Few brokers have a registration page specifically for Islamic accounts, and even fewer have Islamic demo accounts, but some brokers with clients from predominantly Muslim countries automatically create accounts as Islamic accounts.

If you are in doubt, make sure you discuss your concerns with your account manager or broker representative before you make a deposit.