MT5 Features

Regulation: Regulation is needed to ensure your trading funds are safe and that the broker’s trading desk is not manipulating your trades. Although multiple regulators can regulate a broker, a trader should always know which regulator is overseeing your account, as only one regulator will be responsible for your trading account.

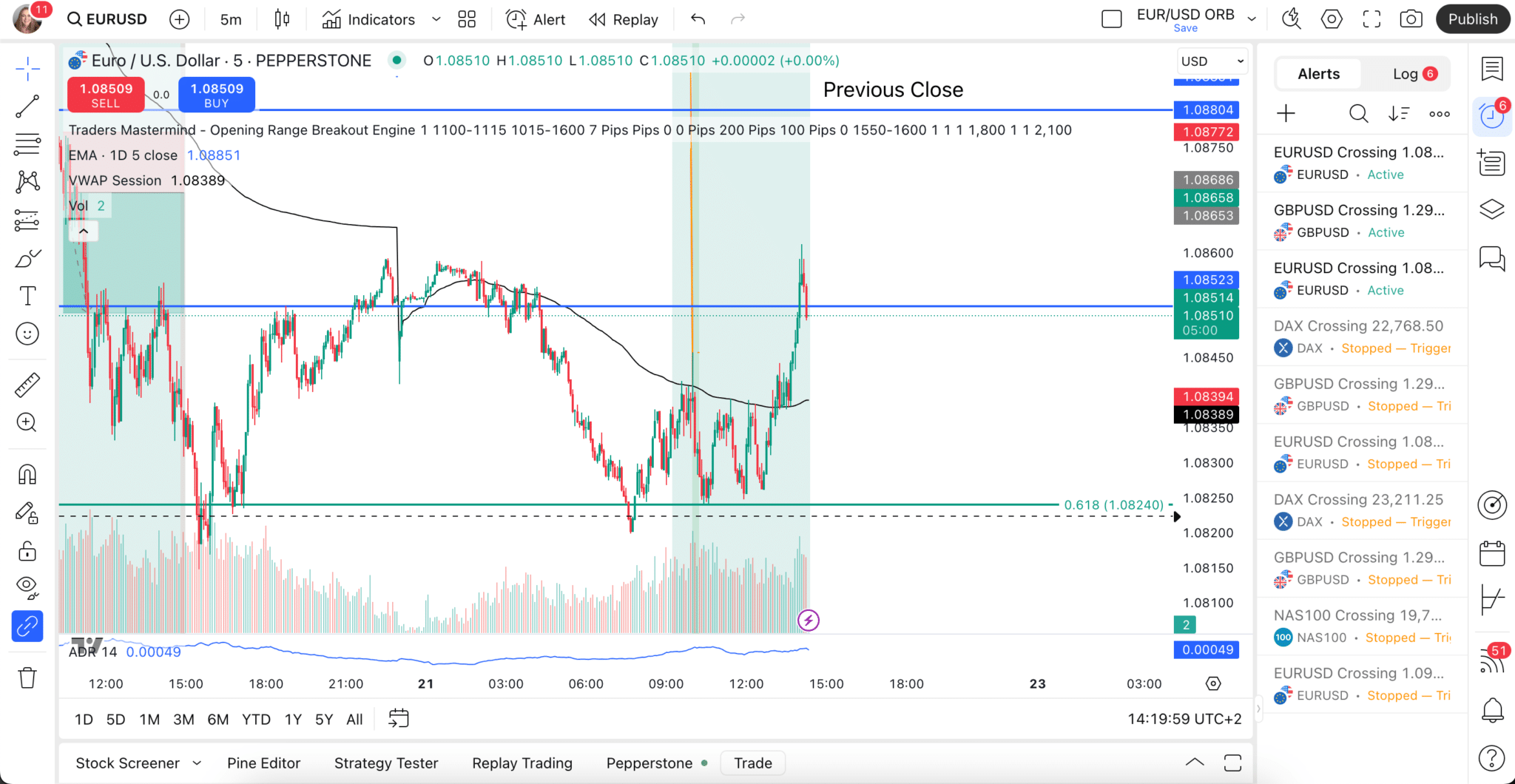

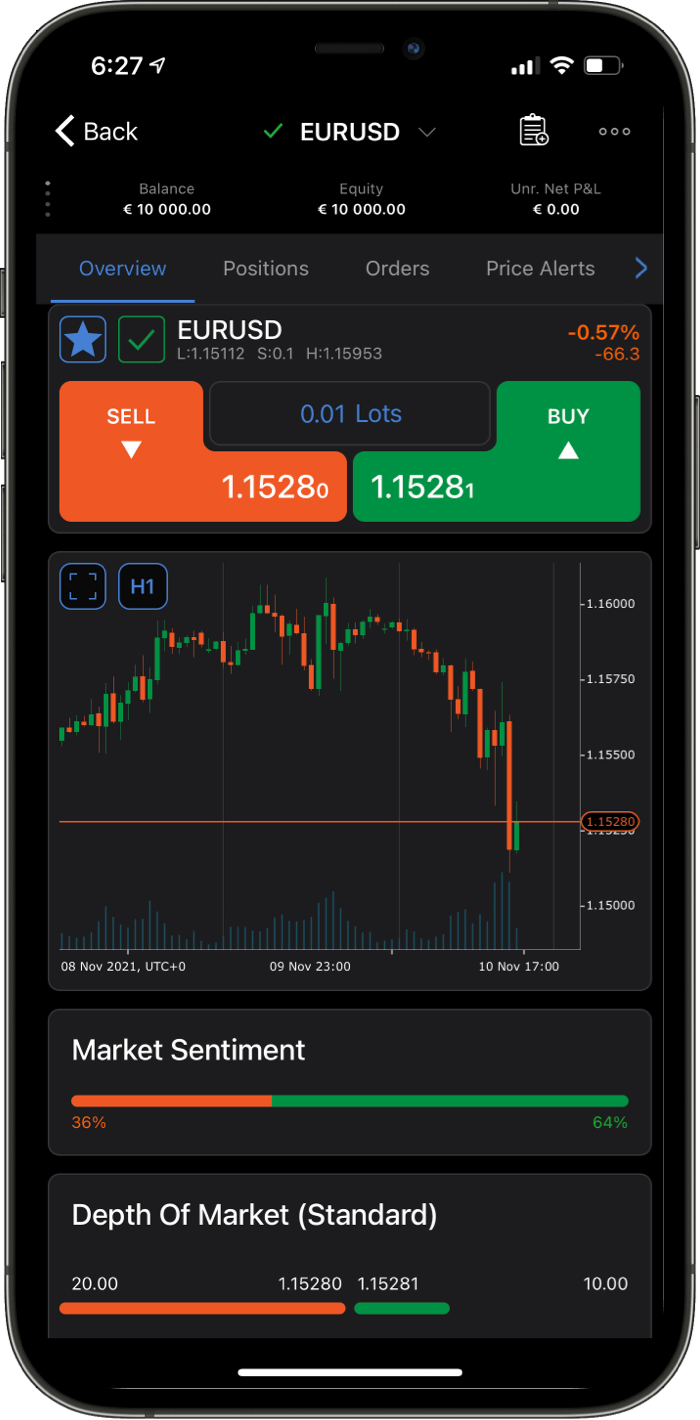

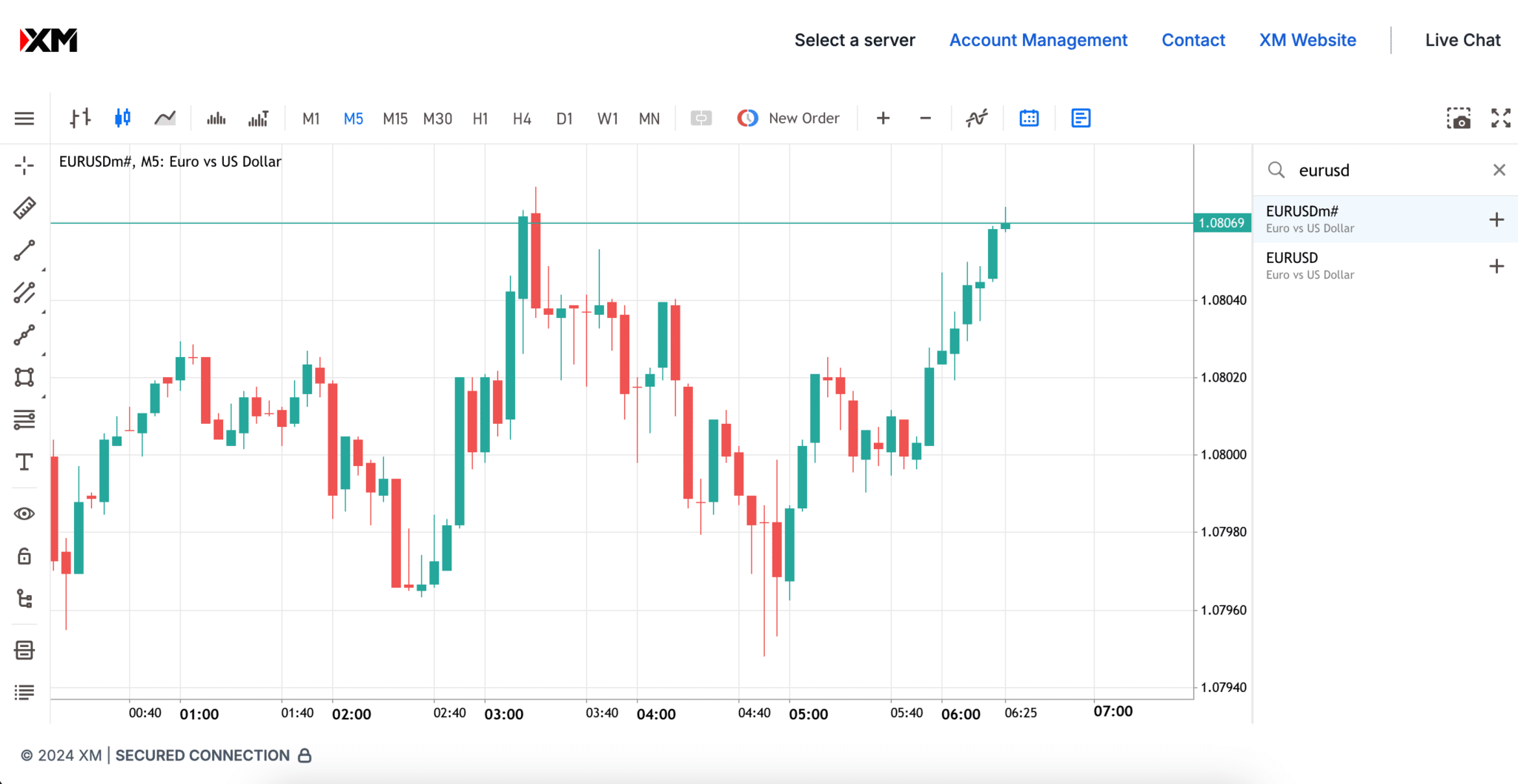

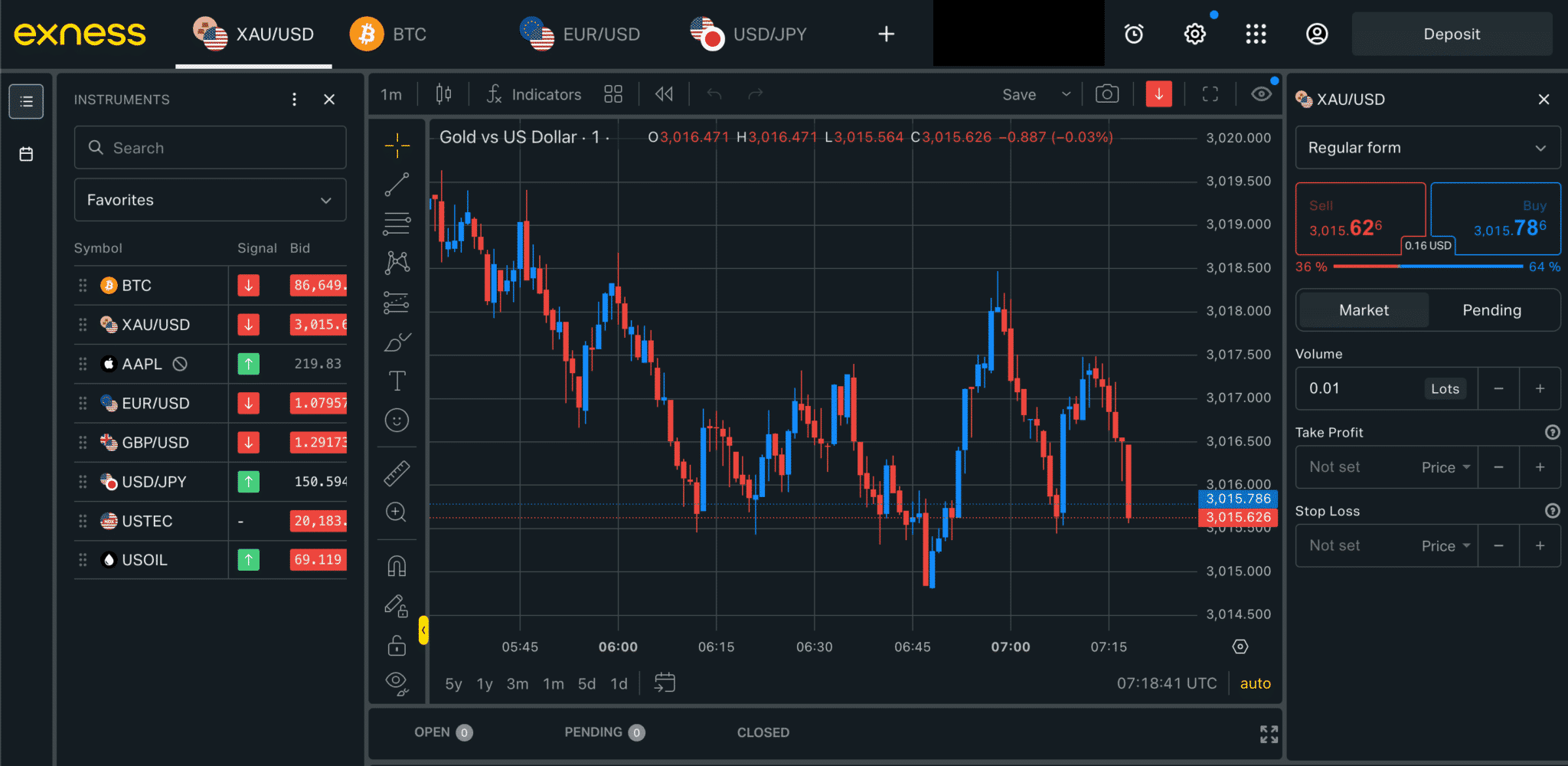

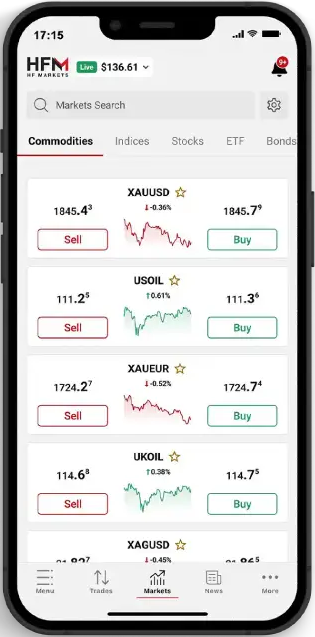

Assets available: One of the main attractions of MT5 is the expanded amount of tradable assets. Research each broker to see who has the most tradable assets and in what classes. Having a wide range of assets means a wide range of trading opportunities. If you plan on mainly trading FX, always check the number of FX pairs your broker has available.

Trading costs: Trading costs, which include spread and commission fees, will vary with each broker. The lower the total trading cost, the more profit a client can make from each trade. Each trading account can also have different trading conditions, so research trading costs on the MT5 accounts are part of your comparison.

Fee structure: While most of the best-regulated brokers will have very few additional fees, additional fees will occasionally emerge. These fees are usually inactivity fees, withdrawal fees, or charges connected with special account types like Islamic accounts.

Trade execution: Trading venue and execution speed are important components of any MT5 trading experience. The trading venue will conclude if your broker is acting as counter-party to your trade or if your broker has found you a counter-party through its network. The trade execution speed will indicate how much slippage you should expect between when you open your position and when it is opened on the market.

Hedging: MT5 does not allow for hedging as standard, so check with your broker to see if they can enable it.

Customer service: A simple check, but check the opening hours for customer service. It is good to know when customer service is available to take your call and resolve issues promptly.