What should I look for in a Forex broker?

At FxScouts, we’ve spent over a decade reviewing forex brokers globally, including those that operate in Africa. We know what matters to beginner Ugandan traders: safety, simplicity, low trading fees, trading education, and local support. These are the factors you need to consider to choose the best broker for your trading needs:

Is the Broker Well-Regulated?

When choosing a Forex broker in Uganda, the most important factor is regulation. Regulation ensures that your money is protected, the broker operates fairly, and there is legal accountability in case something goes wrong.

At present, Uganda does not have a domestic regulator for online Forex brokers. The Capital Markets Authority (CMA) regulates financial markets in Uganda, but it does not yet license or supervise foreign exchange brokers that offer retail trading platforms.

Because of this, Ugandan traders must rely on brokers that are licensed by trusted international financial authorities, which enforce strict standards around client fund protection, transparency, capital requirements, and dispute resolution.

Many of the best brokers in Uganda are operated by brokers that are licensed by top-tier international authorities, including:

Some brokers also hold licenses from other reputable regulators, such as the DFSA (UAE) or FSCA (South Africa).

What Are the Broker’s Trading Fees?

For beginner traders in Uganda, understanding how much it costs to trade is just as important as choosing the best broker. The best Forex brokers are transparent about their fees, offer low-cost trading, and allow you to deposit and withdraw funds easily using local payment methods. Forex trading fees generally include:

Spreads – The difference between the buy (bid) and sell (ask) price of a currency pair. Tight spreads mean lower trading costs.

Commissions – A fixed fee charged per lot traded, common with ECN or raw spread accounts.

Some brokers may also charge overnight swap fees, inactivity fees, or conversion fees if your account currency differs from your deposit currency.

The combination of spreads and commissions makes up your total trading cost per trade, so it’s important to compare brokers carefully. For more information on trading costs, check out these resources:

While most brokers offer accounts denominated in USD or EUR, this can create extra costs for Ugandan traders. Unfortunately, very few brokers offer UGX trading accounts, so if you fund your account in Ugandan Shillings, your deposits will likely be automatically converted into another currency. This can lead to:

- Currency conversion fees

- Exchange rate fluctuations

- Delays in withdrawals to local banks

If a broker does not offer UGX accounts, look for those that accept local currency deposits and offer multi-currency wallets, or low conversion charges.

Look for the following payment methods:

- Mobile money services: MTN Mobile Money, Airtel Money

- Visa/Mastercard: Debit or credit card funding

- E-wallets: Skrill, Neteller, or Flutterwave

- Bank transfers: Where available, with brokers that partner with Ugandan banks or regional financial institutions

Avoid brokers that only offer offshore wire transfers or support via overseas call centers – delays and misunderstandings are more likely.

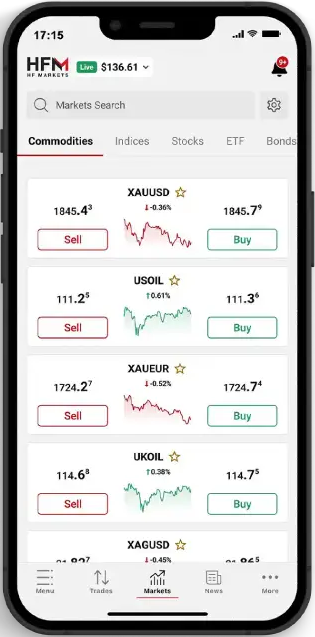

What trading platforms are available?

Your trading platform is your primary interface with the Forex market. As a beginner, we recommend a platform that is:

- Simple to navigate, with walk-through tutorials and FAQ help sections

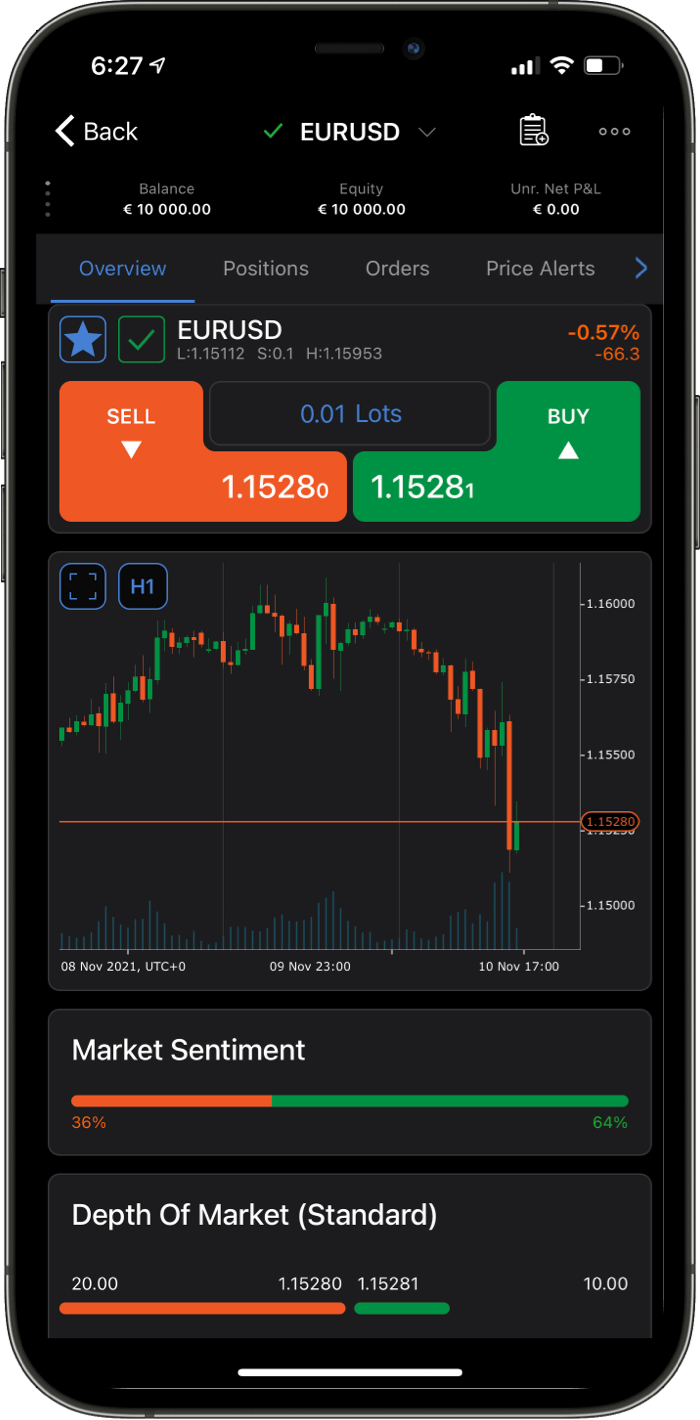

- Available on mobile and desktop

- Supported by educational resources

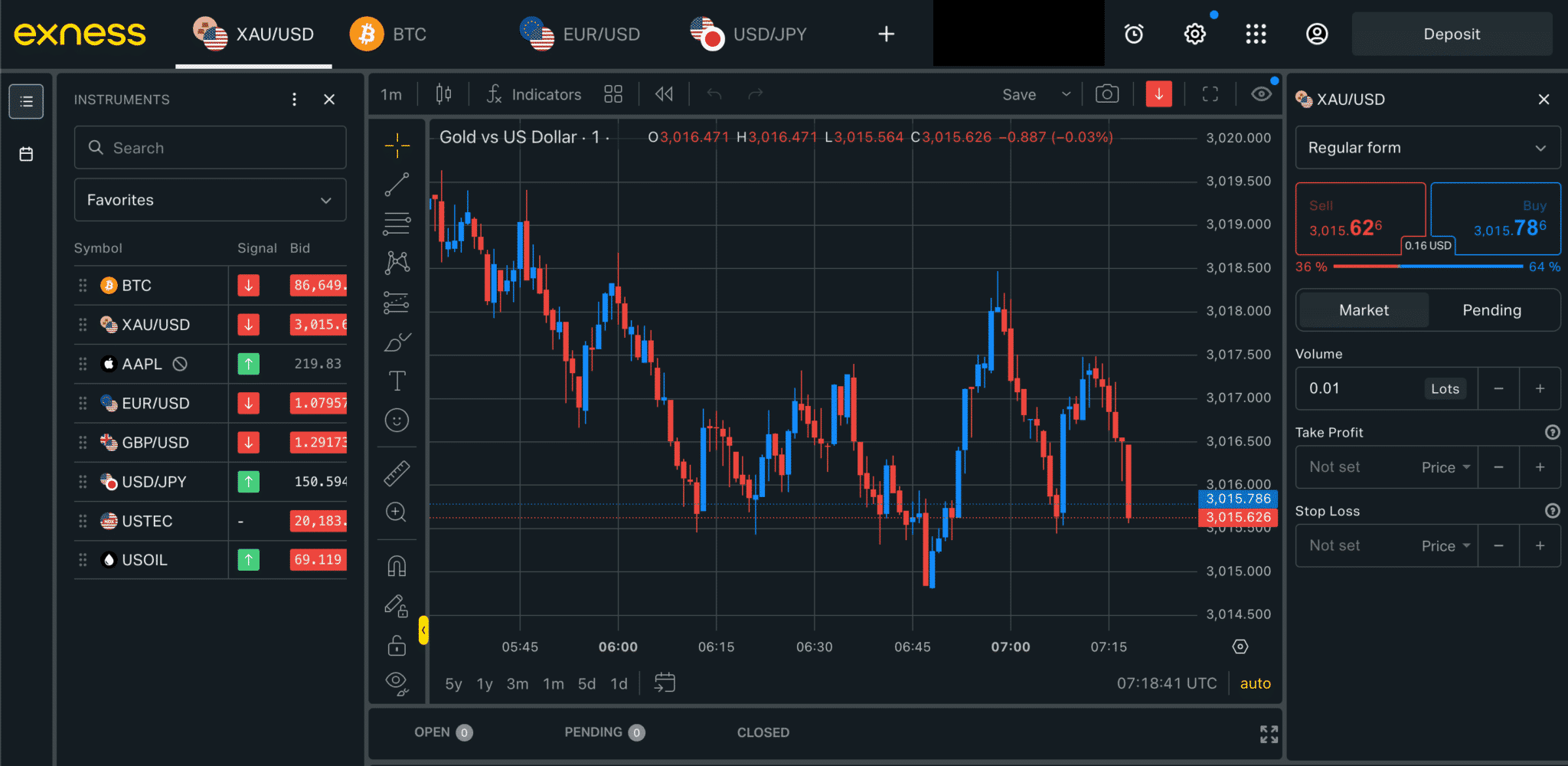

Top trading platforms for beginner Ugandan traders include:

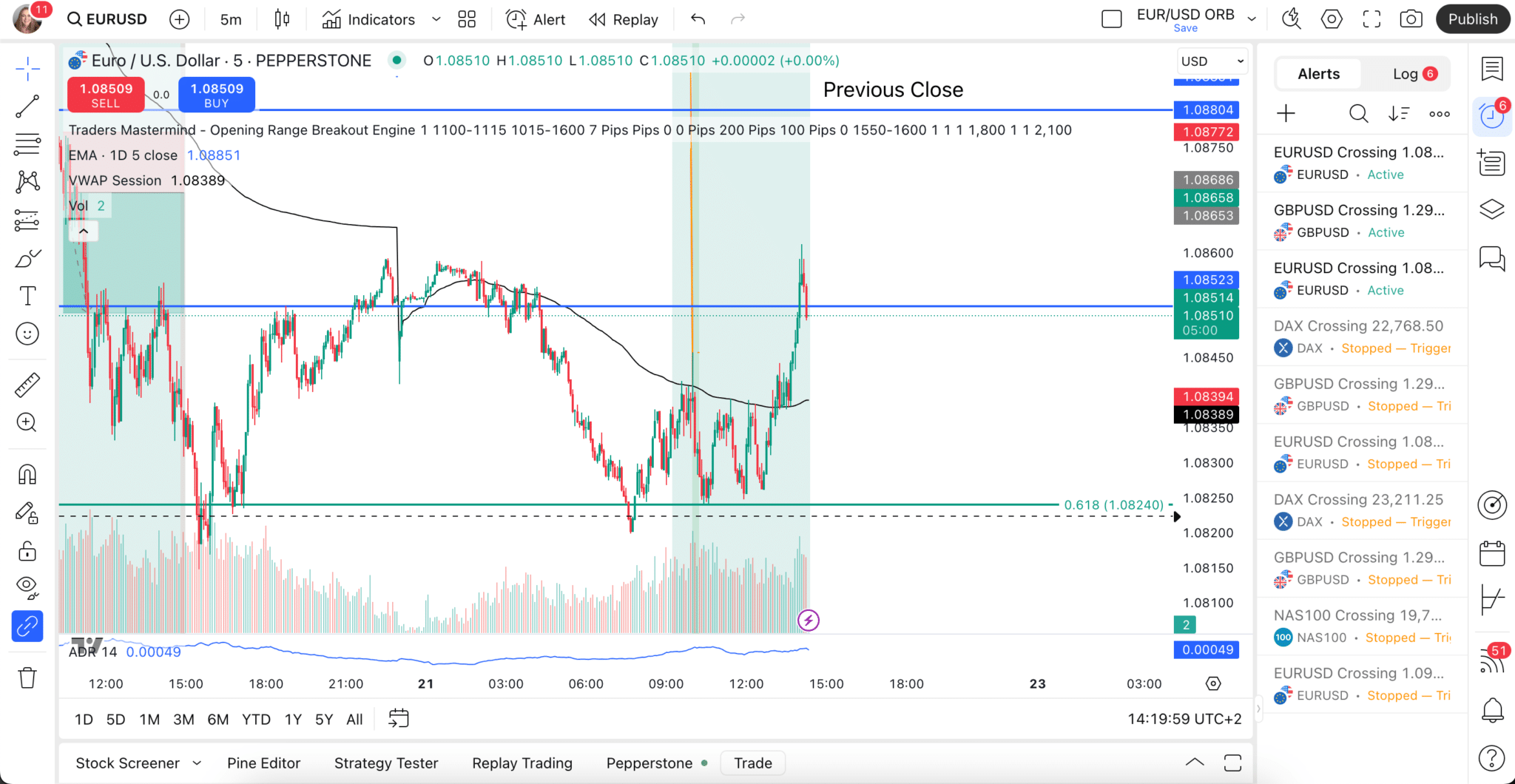

- MetaTrader 5 (MT5): A globally trusted platform with intuitive order entry, customisable charts, and widespread broker support.

- TradingView: Easy-to-use, with excellent trading tools and a live news feed.

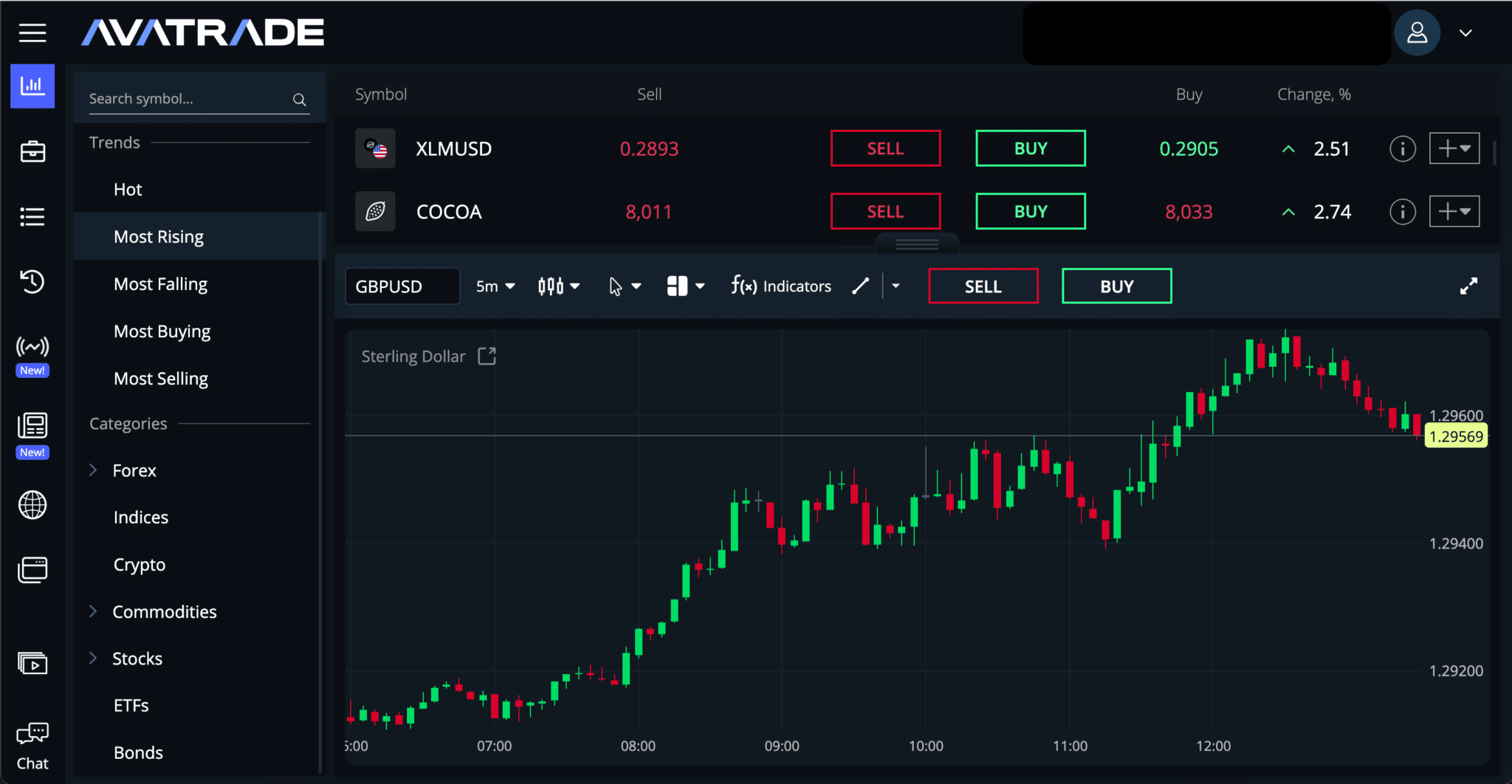

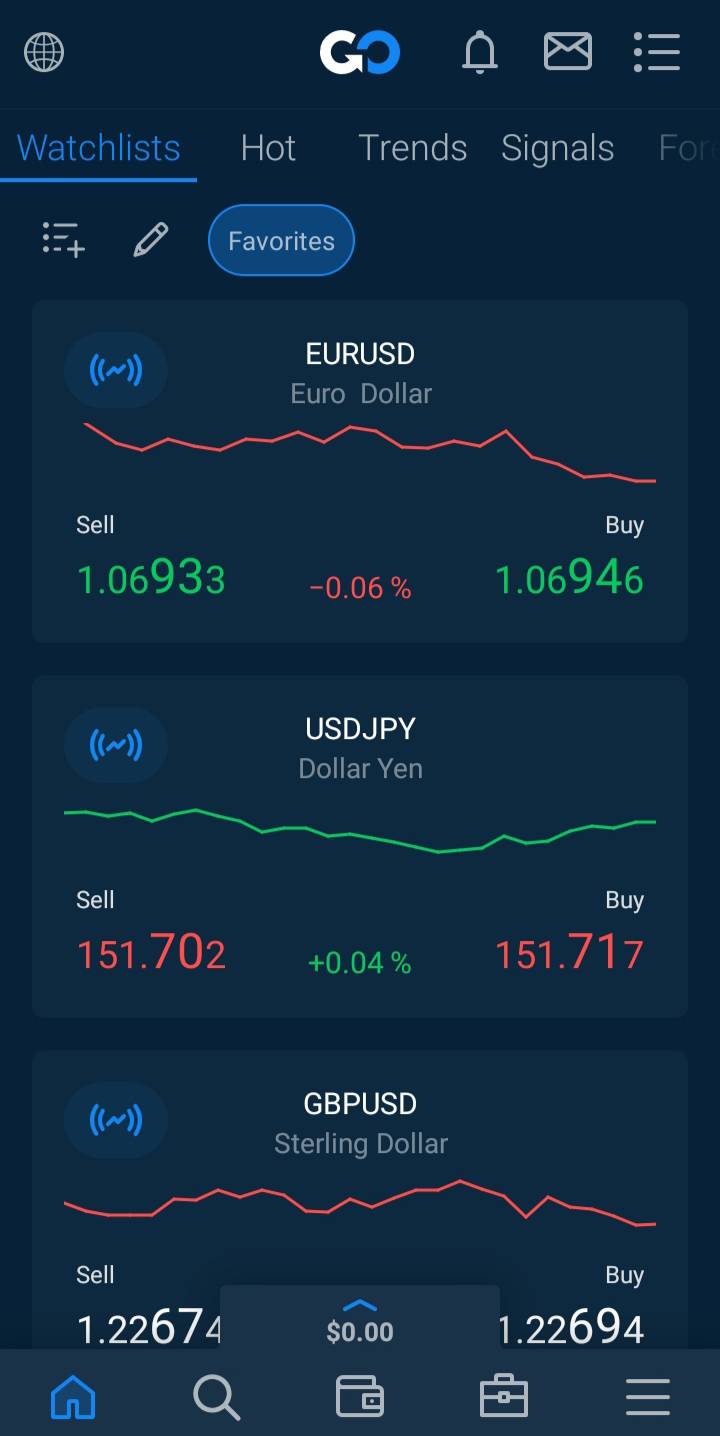

- Proprietary Platforms: AvaTrade, XTB, and others offer simplified mobile-first platforms.

What education does the broker provide?

One of the best ways to learn trading is to start with a demo account and study the market before you invest real money.

We have found that the best brokers offer:

- Unlimited demo accounts funded with virtual currency

- Step-by-step tutorials on placing trades, reading charts, and managing risk

- Articles and videos about how to trade, manage your risk, and implement a trading strategy.

- Live webinars hosted by local experts

- Platform walkthroughs specific to the platforms and tools you’ll be using

- Responsive, local, and knowledgeable customer support

Do they have good customer support?

As a beginner, it’s essential to have responsive and reliable customer support, whether you need help placing your first trade, verifying your account, or resolving a platform error.

What to look for in customer support:

- 24/7 Availability: The markets are open 24/7 during the week, so choose a broker that offers round-the-clock help on trading days.

- Local Expertise: Authorised brokers with Africa-based teams offer better guidance on compliance and local trading issues.

- Multiple Contact Options: The best brokers offer many support channels, including live chat, phone, email, or WhatsApp.

- Knowledgeable and skilled agents: Fast responses matter, but so does quality. Look for brokers with knowledgeable staff who can solve real trading problems, not just read from a script.