Compare Forex Brokers!

Compare top Forex brokers side-by-side and find the best fit for your trading needs. Start your comparison now!

In Forex trading, there are two main types of analysis - fundamental analysis and technical analysis. There is no answer to which technique is better as it depends on a trader’s preferences. Both need patience and discipline on the part of the investor, and time invested in learning how to do the analysis.

Each method has advantages and disadvantages where the distinct differences between the two approaches dictated how traders approach their analysis.

Fundamental analysis is studying the economics of a country, new media, macroeconomic trends, where the trader examines the underlying economic conditions of a currency.

Following the macroeconomic environment can be a rigorous approach if you are not up-to-date on economic news. For traders who have a firm grasp of the financial news, and understand macroeconomics, this could be a very successful approach.

Generally speaking, traders buy currencies with stronger economies at a low price and sell currencies with underperforming economies. Then traders keep these currencies in the hope that prices will move back up to their fair market value. It can take years for undervaluing currencies to rebound and the exchange rate to rise.

As a fundamental trader, be smart about the trades that you choose. If you fail to do so and get caught in a sideways ranging market, you could go without getting paid for some time.

Fundamental traders can profit from significant news events. As a trader with knowledge of an upcoming event, you should research the potential outcome of the event, and buy into your position. The market will become volatile during this event, and the prices before and after will have changed.

Fundamental trading is also better for position traders who keep trades open for more extended periods. This form of trading is even better for those who can not spend time micromanaging trades, which is more reasonable if you have a day job or other obligations that are often prioritised. So, fundamental trading is most appropriate for two types of traders. Either those up-to-date on significant news events and can research thoroughly, or position traders.

If you have time to spend in front of a computer and enjoy chart analysis, then technical analysis could be a better approach for you.

Fundamental analysis is mostly about being aware of upcoming news events, and reacting quickly to the unscheduled ones. Here is some additional reading to get you going.

Here is an example of how the release of positive NFP (non-farm payroll) reports can affect the market. Should a trader expect this report to show robust job creation, we open a trade before the report is released and go long.

Traders have options of how long to keep the trade open for, as this will affect profitability. When a set profit target is reached, a trade can close automatically using a take profit order, or a trader will continue to monitor the data and try to extend the gain, and close the trade manually.

While Fundamental analysis is not chart based, it is essential to understand how to read charts to confirm that the trade is going in the direction expected. In the case below, the chart shows that the trader would have made 100 pips of profit in 5 minutes, and should they have kept the trade open longer, they would have made 200 pips of profit. Having held the trade open a little longer would have been a more profitable trade.

If fundamental traders focus on news events, technical traders concentrate on reading price charts. Technical traders use a variety of tools and indicators to help them identify trends and patterns, and allows traders to identify high probability situations. These are ones in which the currency pair has a good chance of moving in a specific direction.

Experienced traders know how to turn a high probability trade into short-term profits, regardless of whether the market is moving up or down. The ability to make money in any market is one of the most significant benefits of CFD and Forex trading.

A common excuse people have for not learning how to do technical analysis is the notion that you need to spend all day in front of the computer to be successful. The advantage of technical trading is the ability to make good consistent gains in any market without feeling like you have a second job.

Here is some further reading to get you going with the basics.

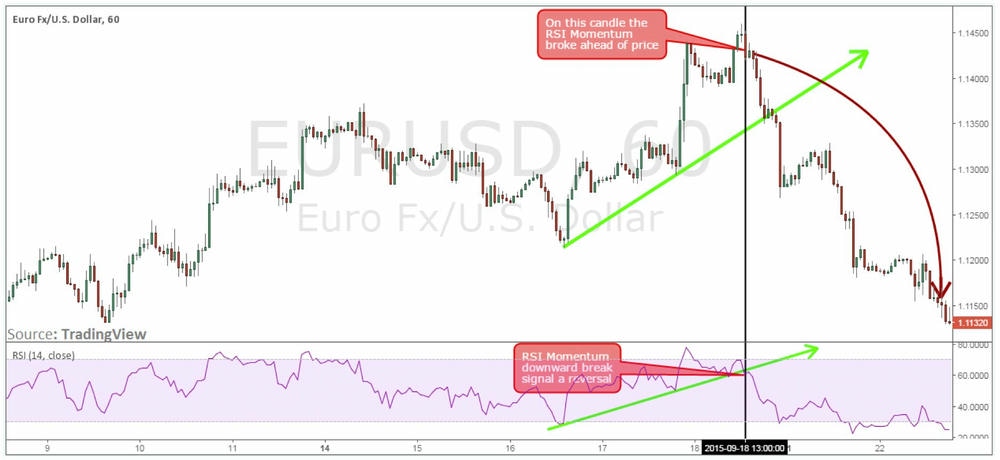

In this example, we are using the charts and a momentum indicator to time the exit of a trade. Because markets will maintain a trend until there is a change in momentum, we can watch for a shift in momentum to indicate that the market could reverse. Investors will close the trade when they see this change, as they know, potential profits are maximised.

Both the technical analysis and fundamental analysis have their limitations, which is the main reason why some professional traders choose to combine the two. If both technical and fundamental data suggest a profitable trade, the probabilities of success can increase considerably.

There is another school of thought that believes that all fundamental factors are already priced into the data, which means that you only have to read the technical data to predict the markets best. If you adhere to this school of thought, then technical analysis is a superior form of trading for you.

Some question the validity of technical analysis. The efficient market hypothesis claims that all past price information is already reflected in the current price. If this is the case, since all the data in the charts is old information, there is no exploitable data to beat the markets. And in this way, fundamental trading is the only way to speculate on future pricing accurately.

Every successful trader knows that it takes study, practice, and dedication to get to the point where you can achieve consistent monthly profits. Whichever way you choose to trade, you have to trade with knowledge and discipline.

You don’t have to worry about which one of the two approaches is better. Instead, take advantage of both of them to help make better-informed trading decisions and help you find more opportunities.

Explore more resources that fellow traders find helpful! Check out these other guides to enhance your forex trading knowledge and skills. Whether you’re searching for the best brokers, educational material, or something more specific, we’ve got you covered.