-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

MetaTrader4 Brokers

The top MT4 brokers

-

MetaTrader5 Brokers

The top MT5 brokers

-

cTrader Brokers

The top cTrader brokers

-

TradingView Brokers

The top TradingView brokers

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

Trading scams have been in the news again recently, and it’s a good time to remind traders of what a Forex trading scam looks like and how to avoid them.

The Australian Securities and Investment Commission (ASIC) recently published a report on its attempts to control online trading scams. Last year, ASIC announced it would start proactively shutting down scam sites targeting Australian residents.

Since July 2023, ASIC has coordinated the removal of over 5,530 fake investment platform scams and 615 cryptocurrency investment scams. Online trading scams remain the leading type of scam in Australia, resulting in 1.3 billion AUD in losses in 2023.

Separately, the Financial Sector Conduct Authority (FSCA) in South Africa published a warning against a group calling itself Bluway Trades targeting traders through the popular social media app TikTok.

But what does an online trading scam look like, and how can you tell the difference between a real broker and a scam broker?

The first thing to be aware of is that most online trading scams are spread through social media. Scammers use Facebook, Instagram, WhatsApp, TikTok and Telegram to find their victims and direct them to their websites. Once on the website, often with the “help” of the scammer, the victims are instructed on how to deposit their funds to start “trading”. The golden rule here is never send money to anyone you meet online, whether through a direct transfer or via a “trading” website.

The second thing to look for is the telltale signs that a website is a scam. The foremost will be language advertising guaranteed returns – as is the case with Bluway Trades. All trading – Forex, crypto, stocks and CFDs – is high-risk speculation, and there is never any guarantee of a return.

Other signs that a website is fraudulent are poor grammar/spelling, the absence of legal documentation (terms of service, client agreements, etc.) and the absence of a regulatory licence. All good brokers will publish their regulatory licences across the bottom of their web pages, which can be checked with the relevant authorities.

You can find more details on how to avoid trading scams here. And if you are looking for a broker, check out our list of the best brokers here. We only work with regulated brokers who treat their clients fairly and only recommend brokers if we think they are truly exceptional.

Quiet markets look to next week’s NFP

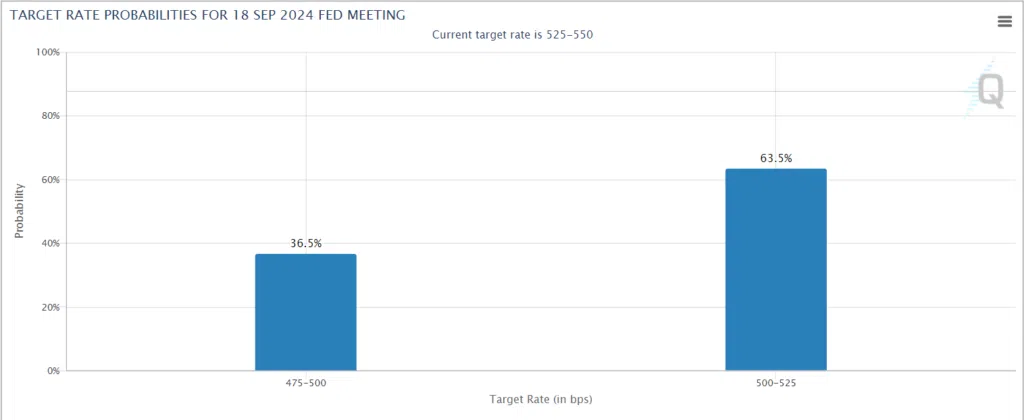

In terms of the markets, we’re in the last days of summer in the northern hemisphere, and things are relatively quiet. Traders will be looking today to the revised US GDP figures for the 2nd quarter and German inflation data, but the big event is next week’s NFP which will give an indication of how deep the rate cut will be at the FOMC’s September meeting.

The probability of a 50bps rate cut hasn’t changed much over the past week, but at 36.5%, it is more than enough to leave traders guessing. Expect a weak NFP to boost that figure to 50% or higher, making the Fed’s decision one of the most significant market events of the year.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.