-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

MetaTrader4 Brokers

The top MT4 brokers

-

MetaTrader5 Brokers

The top MT5 brokers

-

cTrader Brokers

The top cTrader brokers

-

TradingView Brokers

The top TradingView brokers

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

The US markets closed yesterday for the Juneteenth holiday, and the global markets are relatively quiet today.

The Bank of England kept interest rates unchanged, which was a wise move this close to an election. The Rand has been making gains against the USD following the formation of a national unity government in South Africa, but otherwise, overall market sentiment is unchanged. The looming French election and the uncertainty surrounding the Federal Reserve’s monetary policy continue to weigh on the EUR/USD, and with most central banks adopting a wait-and-see approach to inflation, there has been little movement in the currency markets.

But where there has been a lot of movement recently has been in the gold price. Gold has already seen two record highs in 2024, and while the price is currently off the all-time high of $2,450 set last month, it is still up over $300 since February and up 26% since October 2023.

War, speculation and central banks

Gold’s rapid ascent was triggered by the outbreak of hostilities in the Middle East in October 2023 but has been supercharged by speculators, especially in East Asia, and propped up by continued purchases by central banks.

Central banks worldwide were spooked by the United States’ weaponisation of the USD following Russia’s invasion of Ukraine. As the geopolitical situation has worsened over the last two years, the gradual shift away from using the USD as a reserve currency has become a mass movement, led by the central banks of developing nations but drawing in developed economies as well.

With few other choices available, central banks have turned to the oldest haven asset in the world, gold.

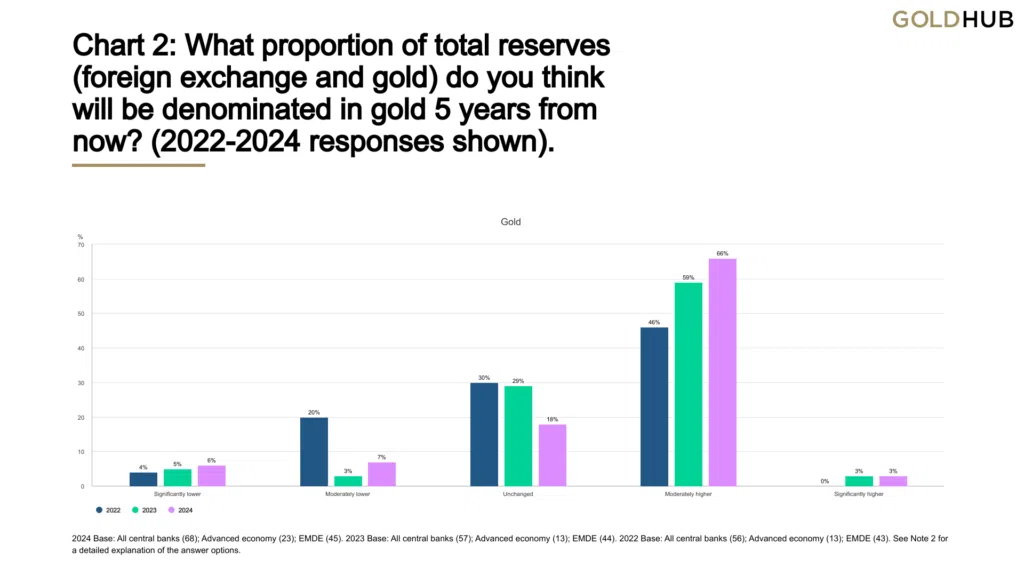

The World Gold Council, an industry promotion group, recently published its annual Central Banks Gold Reserves survey, and the results are interesting for gold and Forex traders. Despite gold’s eye-watering price, most central banks fully expect gold’s share of reserves to increase over the coming years:

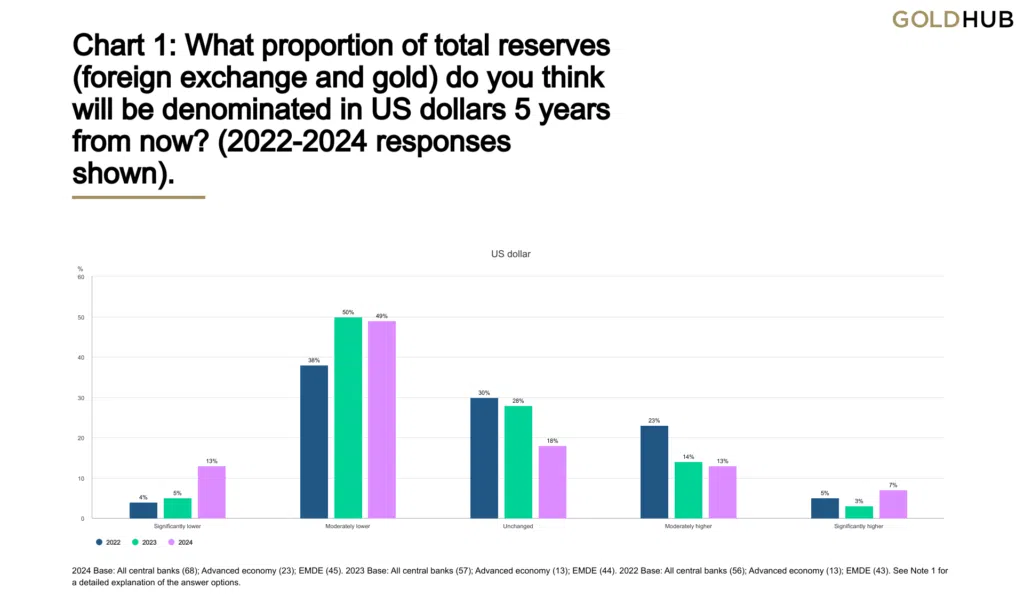

Meanwhile, a rising proportion of advanced economies — 56 per cent, up from 46 per cent last year — also think the dollar’s share of global reserves will fall over the next five years. Among emerging market central banks, 64 per cent share this view.

Shaokai Fan, Global Head of Central Banks & Head of Asia-Pacific at the World Gold Council, said:

“What has been remarkable is that despite record demand from the official sector in the last two years, coupled with climbing gold prices, many reserve managers still maintain their enthusiasm for gold. While influences like price may temporarily slow down purchases in the near term, the broader trend remains in place, as managers recognise gold’s role as a strategic asset in the face of ongoing uncertainty.”

The dollar as a political tool

With the US deficit ballooning and the US election due this November, concern is mounting over the outlook for the USD as the world’s currency. The team behind Donald Trump, the Republican candidate, has made it clear that they would like to devalue the dollar under his presidency – causing further consternation among central banks worldwide. The US Federal Reserve has a non-political mandate, and any political interference in their brief could potentially turn the move to gold into a stampede and lead to a considerable rise in price.

The US deficit is less of an immediate concern. But it is now approaching 1.9 trillion USD, and with neither candidate showing signs of fiscal tightening, it is likely to cross the 2 trillion mark. Given the USA’s importance to the global economy, there is zero chance of an immediate crisis. Still, central bankers make policy on long time horizons, and the ballooning deficit will only further support arguments for moving away from the dollar as a reserve.

The end of negative correlation?

But what does this mean for traders? To start with, it looks like we could be witnessing the end of the negative correlation between gold and the USD. Central banks are less concerned about the price of gold. Their purchasing priorities are now set by the long-term political goal of independence from the USD. Using this argument, gold prices look set to continue climbing.

Geopolitical instability does not look like disappearing anytime soon and no matter who controls the White House over the next four years, the idea of the dollar as a tool will not be going away. With more central banks, including those of advanced economies, moving away from the USD over the coming years there will be consequences for the Forex market. But these are probably decades away and not something to worry about in the short term.

In the short term, as long as the Federal Reserve remains depoliticised, the major pairs will move as expected according to the classic fundamentals (interest rates, GDP, job growth, etc.).

Technical Analysis

Gold gained half a per cent on Thursday, June 20, 2024, rallying past the key resistance level of 2,341 defined by the trendline (blue) and 50-day SMA.

Having reached a crossroads, further supported by RSI sitting at around 50, only a decisive move above its current level could see the bulls gaining momentum. This would mean a clean break above the current level that closed near the day’s high. The next level of resistance would be experienced at the 2386 level – June’s high.

Any downward moves would have to pierce below the 2271 level (April’s low) to be considered significant. Below that, the confluence of the upward trendline (purple) and the December 2023 high of 2145 will act as strong support.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.