-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

MetaTrader4 Brokers

The top MT4 brokers

-

MetaTrader5 Brokers

The top MT5 brokers

-

cTrader Brokers

The top cTrader brokers

-

TradingView Brokers

The top TradingView brokers

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

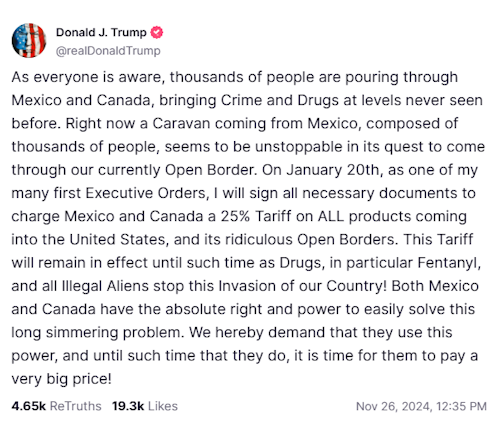

Markets this week were dominated by Trump’s late Monday night post on Truth Social, in which he stated that he would sign an executive order on his first day as President imposing 25% punitive tariffs on all products from Mexico and Canada.

Before Trump’s late-night grammar nightmare, the dollar had slowed its bull run somewhat. On Friday last week, Trump had announced hedge fund manager Scott Bessent as his pick for Treasury Secretary. Bessent, an experienced financial executive who has previously attacked the Federal Reserve’s political independence, was seen as weak for the dollar – whether through curtailing Trump’s more inflationary policies or, more controversially, manipulating the Fed into reducing interest rates.

The DXY fell on the news of Bessent’s appointment. However, 24 hours later, in market terms, Trump’s outburst flipped the narrative again. It was a reminder to the markets that, no matter who Trump appoints to his inner circle, he would always have the final say, and it would often come from social media when you least expect it.

A 25% tariff on all goods from Mexico and Canada to the US would be damaging to all three countries. The US accounts for 80% of Mexico’s exports, while the Mexican and Canadian economies rely heavily on imports from the US across all sectors. More importantly for US consumers, Canada and Mexico are responsible for more than 70% of US crude oil imports.

The impact on US energy prices, in particular, would be immediate and inflationary, the opposite of Trump’s professed intentions.

In addition, the latest CPI report released yesterday showed that US Inflation ticked up slightly in October, meeting market expectations at 2.3% and up from 2.1% in September. With the Federal Reserve already sounding more cautious in recent weeks, some analysts are beginning to think the Fed may look to slow or halt its rate-cutting programme.

Omair Sharif, chief economist at Inflation Insights, wrote in a client note: “This report will likely provide further ammo to Fed officials who prefer to lower rates gradually, and may strengthen the argument for a pause at the December FOMC meeting.” While most analysts and futures traders still believe the Fed will cut rates by another 25 basis points on December 18, further cuts in the new year are looking less likely.

The first takeaway is that medium-term political and monetary outlooks point to a stronger US dollar. The question is, how strong?

The second takeaway is the return of Trump-led volatility. Markets in the US are closed today for the Thanksgiving holiday, so things are relatively quiet. However, with Trump back on his way to the White House and governing via social media, currency markets will be particularly sensitive to further outbursts.

Kamakshya Trivedi, head of global foreign exchange, interest rates and emerging markets strategy research at Goldman Sachs said:

“Investors should get ready for a wild ride in FX volatility. This is going to be something that we are all going to have to get used to. It is going to be volatile moves in FX markets because… currencies are to some extent the primary means of responding to any sort of tariff announcement.”

Technical Analysis

Following the EUR/USD’s rally to above the 1.0600 psychological level on Wednesday, the pair retreated back towards the 1.0520 level early in the trading session. All indicators point to a bearish bias, with the pair having broken through a long term key support level last week. As expected, the price is pulling back to retest the level, and a break below the 1.0404 level will indicate further downside moves, towards the 1.0330 level. A firm break above 1.0600 could see the price head into the 1.0760 territory.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.