-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

MetaTrader4 Brokers

The top MT4 brokers

-

MetaTrader5 Brokers

The top MT5 brokers

-

cTrader Brokers

The top cTrader brokers

-

TradingView Brokers

The top TradingView brokers

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

There’s only one thing to talk about today: the slow-motion car crash which is the Japanese Yen.

The USD/JPY has been a happy hunting ground for Forex traders since the start of the year, as Japan’s ultra-loose monetary policy has come into direct conflict with the Federal Reserve’s hawkish response to inflation.

Japan’s history of ultra-low rates

From 2016 until March of this year, the Bank of Japan had kept interest rates negative. While many countries were dealing with double-digit inflation, Japan struggled to stimulate growth.

However, the Bank of Japan’s negative interest rate policy was only an exceptional form of large-scale monetary easing that has continued for many years. Japan’s history of ultra-low interest rates is much longer and dates back to the late 1990s.

The BoJ decided to implement a zero-interest rate policy in 1999. Since then, short-term policy rates have been extremely low, whether they were zero, near-zero, or slightly negative. An exception was a short period from 2006 to 2008 when policy rates were low but positive. Rates went back to near-zero levels again after the global financial crisis ended.

The BoJ’s ultra-loose monetary policy reflects the fact that the Japanese economy has suffered from secular stagnation and mild but persistent deflation for the past 20 years.

2024 and BoJ Intervention

Since the start of 2024, the yen has come under severe pressure and weakened considerably against the dollar. With interest rates in the US at record highs, the BoJ finally caved to pressure and ended its negative interest rate policy in March. However, this failed to prevent speculation, and the BoJ was forced to intervene in late April/early May to defend the yen after it approached 160 to the dollar. It’s thought that the BoJ’s intervention may have cost somewhere in the region of 61 billion USD.

BoJ primed to intervene again

The intervention bought the BoJ some breathing room, but without any major change in the fundamentals the yen has weakened again in the last month, and depreciation against the dollar has accelerated in recent days.

Yesterday, Japan’s vice finance minister for international affairs, Masato Kanda, blamed speculation for the recent depreciation and hinted at further intervention:

“It is generally accepted that the current weakness in the yen is not necessarily justified, therefore believed to be driven by speculators… We have been preparing to act against excessive volatility.”

Markets have shrugged off Kanda’s warning, and the yen has stayed above 160 to the dollar. Analyst sentiment is that any intervention will only occur if US data releases today and tomorrow fail to ease pressure on the yen.

Whatever happens, the USD/JPY pair is set for further volatility. The BoJ’s previous interventions have seen moves of over 500 pips, so prudent risk management is especially important for traders trying to take advantage of the situation.

Technical Analysis

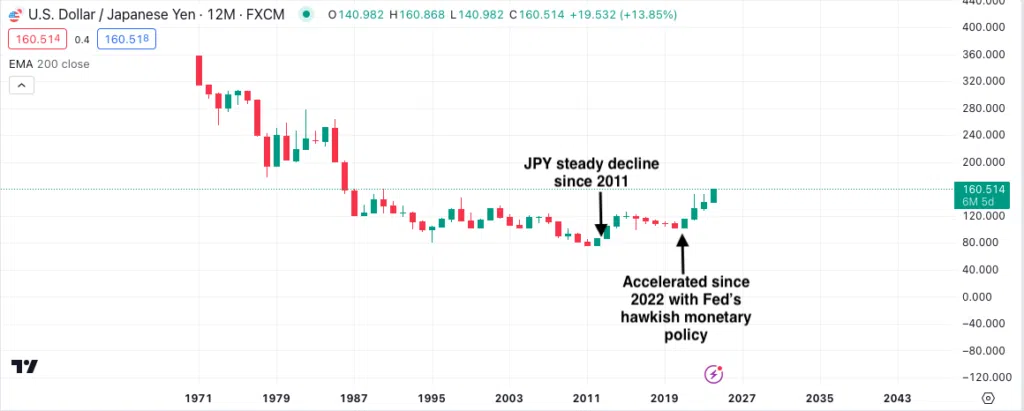

The Japanese Yen’s weakness isn’t a recent development. Its value has steadily declined since peaking above 80 Yen to the USD in 2011. The downward trend (or upward USD/JPY trend) accelerated in 2022 with the Fed’s hawkish monetary policy stance to try to combat inflation.

Having retreated from its highest level since 1986 of 160.87, the Yen corrected to below 160.50 during the London session. As mentioned, this is likely due to Kanda’s warning that intervention may be warranted should the currency pair continue its climb.

From a technical perspective, the USD/JPY has been in a firm uptrend, riding high above all three EMAs (50,100, and 200-day EMAs) since the beginning of the year. The RSI is just outside oversold territory, having corrected to 69.83, which means that price has a little bit of wiggle room for upside moves. The MACD also confirms the upward momentum, with the MACD and signal lines having crossed above zero, and the presence of the green histogram.

However, with further upside moves, the BoJ may have to intervene like they did in April/May of 2024, which could cause the pair to drop significantly. In this case, traders will be watching the 160.00 psychological handle for signs of support and, below that, the 158 level. Should speculators continue to push the price up, traders will be focused on the 161.00 level.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.