-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

MetaTrader4 Brokers

The top MT4 brokers

-

MetaTrader5 Brokers

The top MT5 brokers

-

cTrader Brokers

The top cTrader brokers

-

TradingView Brokers

The top TradingView brokers

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

Since Trump’s victory in the US election two weeks ago, the EUR/USD has been under extreme pressure, falling from 1.093 down to the psychologically important 1.050 handle before stabilising.

While the price drop seems to have paused for the moment, there appears to be no end in sight for the malaise affecting the EUR/USD. Future monetary policy in the US and the impact of Trump’s economic policy all point to a stronger dollar. Conversely, future policy in the eurozone seems to point to a weaker euro. To make things worse, the sudden and unexpected escalation of the war in Ukraine is adding further bearish pressure.

Interest rates in the US to remain elevated?

With inflation remaining stubborn in the US and the prospect of tariffs under Trump adding fuel to the fire, Federal Reserve officials have sounded more cautious in recent weeks.

In a speech on Wednesday, Fed Governor Michelle Bowman, the lone dissenter on the Fed’s big 50 basis point rate cut in September, warned that the fight against inflation was far from over. She said:

“I would prefer to proceed cautiously in bringing the policy rate down to better assess how far we are from the end point… We have seen considerable progress in lowering inflation since early 2023, but progress seems to have stalled in recent months.”

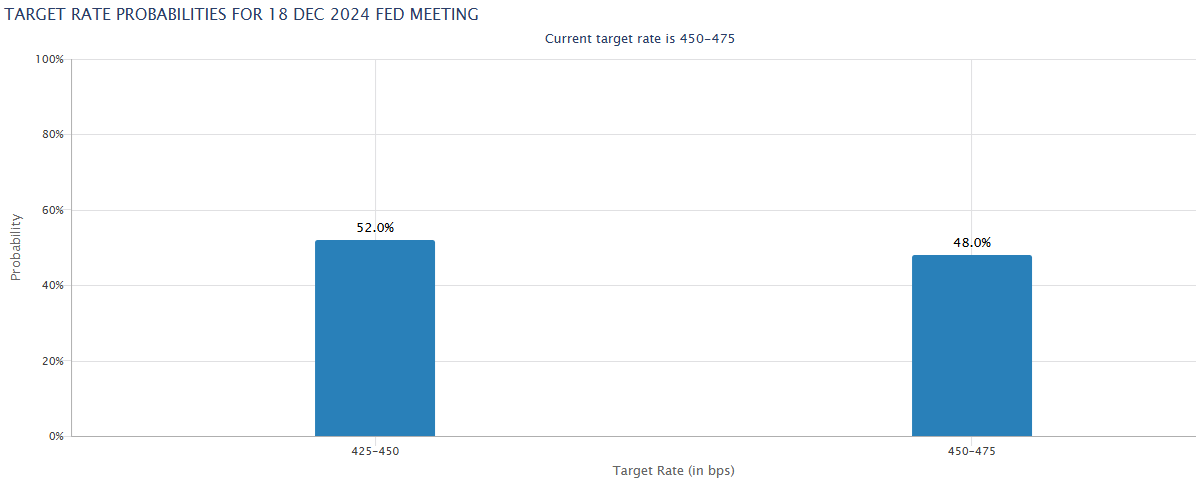

Futures traders are now close to an even split on whether the Fed will lower interest rates in their meeting on December 18, with 52% expecting a cut and 48% expecting a hold.

EU growth concerns outweigh inflation risks

Meanwhile, on the other side of the Atlantic, analysts believe the ECB may accelerate the pace of rate cuts as economic growth across the EU continues to disappoint.

On Wednesday, Governor of the Bank of France François Villeroy de Galhau said that “the balance of risks on growth and inflation is shifting to the downside.” He also underscored the ECB’s commitment to “continue to reduce the degree of monetary policy restriction” while underlining that the pace must be guided by “agile pragmatism” and “full optionality.”

While ECB officials publicly rule out the impact of potential tariffs on their inflation outlook, fears remain that Trump’s protectionist policies will particularly impact the EU economies.

High rates in the US, low rates in the EU, and a weak EU economy—even before the prospect of tariffs is considered—can only lead to further downward pressure on the EUR/USD.

Escalation in Ukraine

In further bad news for the common currency, the war in Ukraine has again taken centre stage. Two days ago, the outgoing US administration authorised Ukraine to use long-distance ATACM ballistic missiles on Russian soil. The UK government followed suit, allowing Ukraine to use Storm Shadow cruise missiles against Russian targets. This morning, Russia responded by firing a non-nuclear ICBM on Dnipro.

Needless to say, any escalation of the conflict in Ukraine is bad news for the EU. The EUR/USD weakened from 1.055 down to 1.051 on the news of the Russian ICBM launch, and the EUR will remain under further pressure until the threat of further escalation has been removed.

Technical Analysis

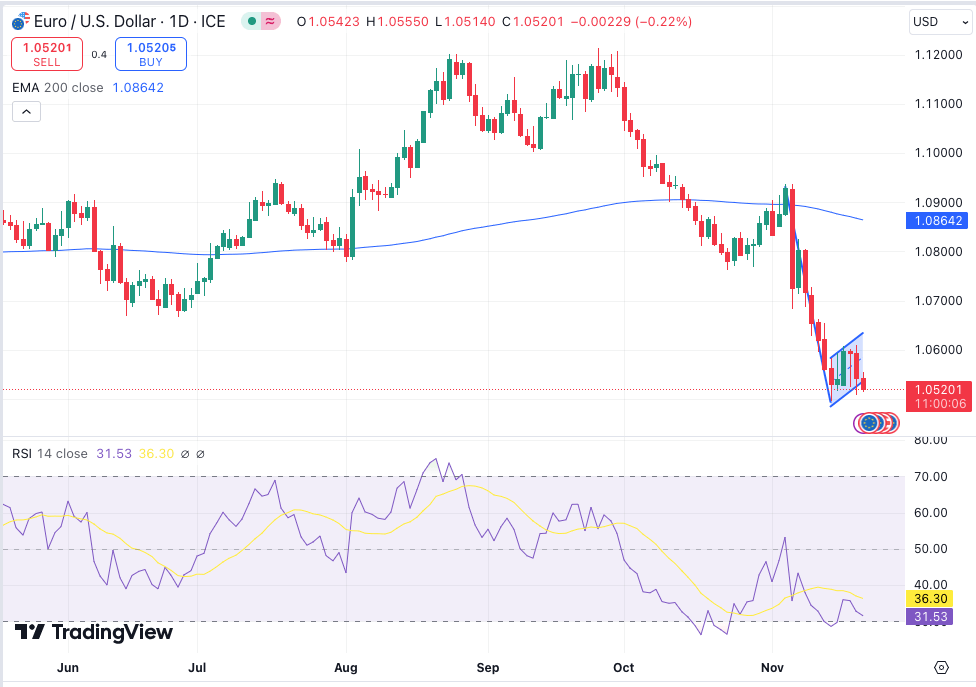

The EUR/USD traded below 1.0520 in the early European session on Thursday, having closed in the red on Wednesday. From a technical standpoint, the pair remains bearish in the near term, with the RSI below 50, but just above oversold territory.

A bear flag confirms this downside bias, with price having just broken below the lower channel line. Still, the 1.0500 remains a key psychological support level before 1.0450 and the 1.0420 levels.

If the pair manages to rise above the 1.0600 level, this could renew buying interest. The focus would then be on the 1.0670 level as the next major resistance.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.