Compare Forex Brokers!

Compare top Forex brokers side-by-side and find the best fit for your trading needs. Start your comparison now!

Forex brokers provide traders with the means to access the forex market and trade on it via platforms. Brokers make the money to pay for the service they provide via a number of means, including spreads.

The spread in forex trading refers to the difference between the buy price (also known as the offer or ask price) and the sell price (also known as the bid price) quoted for a currency. The price at which traders can buy a currency at a given moment in time is always higher than the price at which they can sell it, and the difference or “spread” provides the broker with a small profit to finance their operations. The easiest way to understand the concept of spread is to imagine you have a car that you want to sell to a dealer. He may offer you US$10,000 to buy the car and it might later go up for sale on his forecourt for US$10,500. The difference, or “spread”, in this case, is US$500 and, after he has paid his costs, it will generate a profit for the dealer.

A wide spread means there is a greater difference between the two prices, and that is usually an indicator of low liquidity and high volatility. By contrast, a narrow spread indicates low volatility and high liquidity. The cost incurred when trading a currency pair with a tighter spread will be smaller than that incurred when trading a pair with a wider spread.

Spreads are measured in “pips”, a measurement of the smallest price move that an exchange rate can make. Most currency pairs are priced out to four decimal places, and the pip is the last decimal place. For example, if you are trading the euro against the dollar, you may see the following quote on your screen: “EUR/USD 1.1453 – 1.1456”. In this case, the spread is three pips: the difference between the bid price of 1.1453 and the ask price of 1.1456.

Currencies are affected by various factors, including market volatility. Forex traders follow news feeds closely because economic and political developments help determine supply and demand for currencies. The US dollar, for example, is regarded as a haven in times of trouble, so demand for the dollar can spike if global equities come under pressure. Or if the economic news suggests that interest rates in the US are going to increase, the dollar will again rise because buyers know they will get a greater return on their dollars. Moreover, supply and demand can vary during the trading day, with spreads widening during quiet periods and narrowing during active periods.

A broker may charge either a fixed spread or a floating spread, as explained below.

As their name suggests, fixed spreads remain constant. In the case above, where you are quoted “EUR/USD 1.1453 – 1.1456”, the broker charges a fixed spread of three pips. The difference between the bid price and the ask price will always be three pips, regardless of market volatility.

The advantage of fixed spreads for traders is that they provide transparency in terms of trading costs. Forex trading strategies are often focused on the short term and involve enacting numerous trades in a short period of time. With fixed spreads, you know exactly what your costs will be each time you trade, ensuring you can budget the transactions well in advance. This improves your ability to manage costs.

Fixed spreads also ensure that brokers cannot manipulate the spreads in their favour.

Floating spreads (or variable spreads) vary constantly over time. This is the most common way that professional forex traders interact with the market. The spread fluctuates due to changes in supply, demand and total trading activity.

Variable spreads are often cheaper than fixed spreads, especially when liquidity is high. However, they can widen quickly in times of extreme volatility.

The cost of spreads, either fixed or variable, can have a significant impact on a trader’s profitability, so it is important that you know how to calculate these costs. The easiest way is to use a spread cost calculator; many of these are available for free on the internet.

However, the calculation is straightforward and can be done using an ordinary calculator or even in your head. Imagine a trader wants to go long or buy euros, and the bid–ask price on the broker’s trading website is again EUR/USD 1.1453 – 1.1456. If you deduct the bid price from the ask price, and do the percentage calculation, you can see that the spread is 0.03% for every lot of EUR/USD that you trade.

Some brokers charged a fixed fee, which makes calculating costs very easy. A broker may, for example, charge a US$1 commission per executed transaction, regardless of currency prices or the size of the trade. However, the most common practice is to charge a variable commission, which changes depending on the amount traded.

Beginner traders should understand that the total costs of trading could involve more than just the spread cost. So, while it is probably wise for a beginner to seek out brokers that offer the tightest spreads, they should be aware that there are other factors to consider.

The main costs of trading are:

Now imagine you close your trade with a 100-pip profit – a handsome profit target for a new trader. Your total profits would equal US$1,000. Deduct the aforementioned fees to arrive at your net profit.

Forex brokers tend to offer several types of trading account, with two of the most popular offerings being standard trading and raw spread accounts. Trading costs vary between the two accounts and which is best for you will depend on factors such as the volume of trading you are undertaking and the strategies you are following.

This refers to the entry-level accounts aimed at retail traders. Brokers tend to make their money from spreads, which vary from 1 pip upwards. No commissions are charged on trading with these accounts.

Also called an ECN account, these offer real market prices for all instruments. Forex brokers will not add any markup to forex prices, so the spreads are usually extremely low or even zero. However, traders have to pay a commission fee for each trade executed. Some forex brokers charge the fees for each opening and closing trade (“per side”), while others may charge fees after one full round-trip, i.e. the opening and closing of a lot.

To explain the difference between the two types of account, imagine you want to trade EUR/USD at 1.1451. If you have a raw spread account, you will probably be able to buy the euro at 1.1451 (i.e. there is no spread on the real market price). As soon as the price rises by any amount, you can close the position and take your profits, after calculating the commission you paid.

However, if you have a standard trading account, you will probably only be able to buy a lot at the ask price of 1.1453. This means you are going to incur a loss of 2 pips as soon as you enter the trade. In order to close the trade at profit, EUR/USD has to rise by at least 3 pips.

If you follow a scalp trading strategy, which involves moving in and out of markets quickly and often during the day, banking small profits on a regular basis, you are likely to want a raw account. That is because you need to profit from minor changes in asset prices and spreads can wipe out the small margins you are hoping to benefit from.

However, if you are a swing-trader or position trader, looking to benefit from relatively large changes in prices by taking out positions over a few days or even longer, then a standard trading account is likely to be better.

In general terms, trading with zero spreads is cheaper and therefore preferable. Traders are able to access the market directly and have the chance to manage their trades more precisely, while benefiting from fast execution speeds. The system used by brokers, known as ECN, is automated, so it can’t be manipulated and the prices that you see are real market prices.

However, you will still pay trading costs. These are likely to be in the form of commissions, but there could also be a higher account opening requirement or lower margin calls and stop-loss levels, or a combination of all of these. Brokers may also not offer negative balance protection.

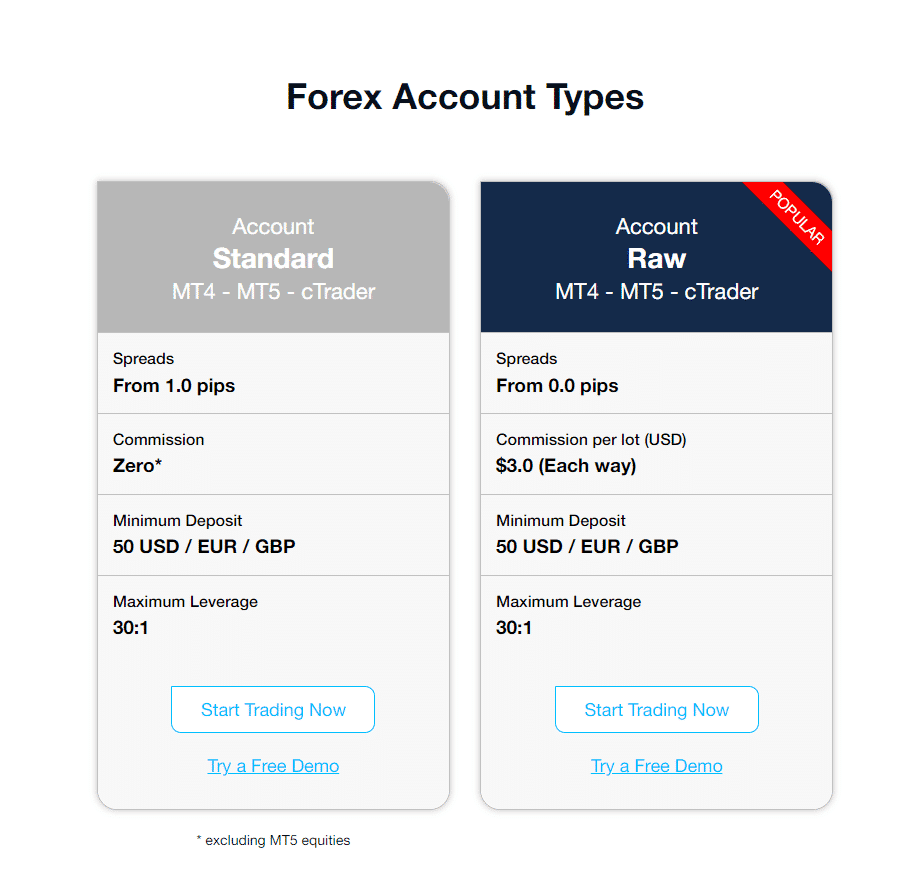

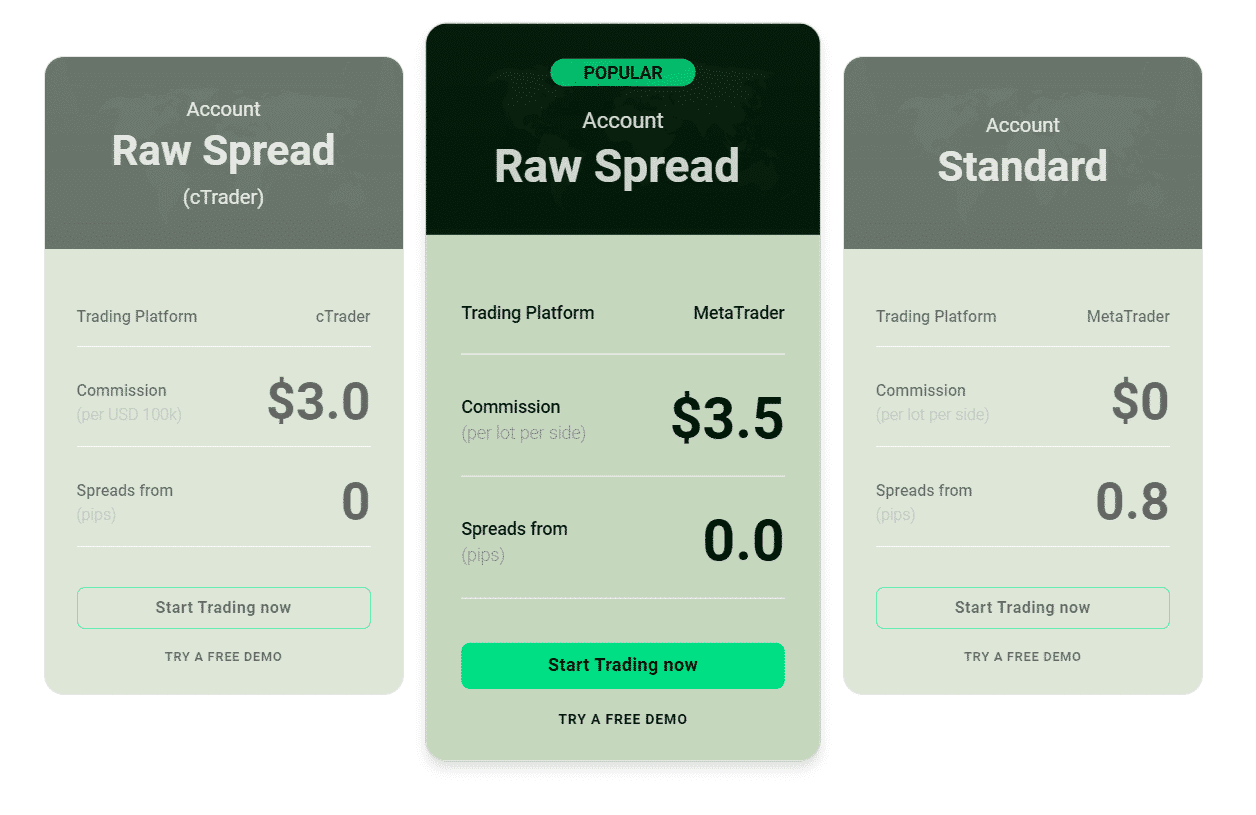

Below are some examples of the different accounts offered by brokers and the charges they levy.

FP Markets Account Types September 2024

IC Markets Account Types September 2024

Axi Account Types September 2024

Explore more resources that fellow traders find helpful! Check out these other guides to enhance your forex trading knowledge and skills. Whether you’re searching for the best brokers, educational material, or something more specific, we’ve got you covered.