Compare Forex Brokers!

Compare top Forex brokers side-by-side and find the best fit for your trading needs. Start your comparison now!

Multiple time frame (MTF) analysis is a top-down approach to studying price action. Using Multiple time Frame Analysis will teach you to look at charts over several different time frames to detect and validate market trends.

MTF analysis is a top-down approach of studying the price action, starting with a longer time frame and moving down to intraday charts. It’s important to note that longer time frames usually make the overall market trend more visible.

MTF is used to identify trade entry points. A multiple time frame strategy will position trades in the direction of the overall trend while using market trends on shorter time frames to pinpoint optimal trade entry points.

In this strategy, we are looking to identify similar patterns of movement in the charts over an assortment of different time frames. As an example, a trader may identify a bullish/bearish trend in the charts both on both longer and shorter time frames.

MTF analysis consists of the following three components:

In this example, we will work with three different time frames to identify a pullback and a breakout trend. First, we will have to select a time frame matching our overall trading strategy, which we will call “preferred time frame”. The preferred time frame selection depends on your overall trading strategy; example whether you are a day-trader or trading over a longer period. The general rule is to use the preferred time frame as the “Medium time frame”.

The second time frame called the “Long time frame”, is selected by multiplying the preferred time frame by 5 and the third time frame called the “Short time frame” is selected by dividing the preferred time frame by 5. Note that these rules are not set in stone, and in some cases, the Long/Short time frames can be found multiplying/dividing by 4,5, or 6.

Also note: The daily chart should be used as Preferred time frame if an intraday chart is used as a trading strategy.

At the end of this exercise, you will have three different time frames to use. They are:

For example, if your preferred time frame to trade is the 1-hour chart, this will be your intermediate time frame. The daily chart will, in this case, be used as the long-term time frame and the 15-minute as the short-term time frame.

The secret to managing your trades starts with having a top-down trading approach. Moving forward, we’re going to reveal the power of MTF analysis by following a simple step-by-step trading strategy that you can implement in your trading approach.

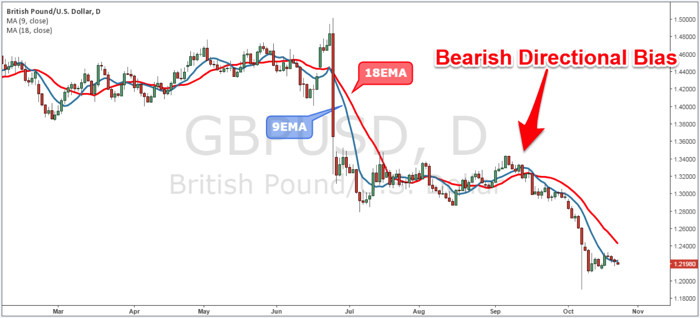

We will start by looking at the long-term time frame. This time frame indicates the current trend and will help us establish the directional bias. In this example, we have selected the GBP/USD currency pair.

Figure 1: With the help of plotting the 9 and 18 moving averages on the GBP/USD daily chart to identify the market trend. Here we can determine that the market trend currently is negative (bearish trend), which indicate the underlying market trend is to go short, meaning selling the currency pair.

Figure 1: GBP/USD Daily Chart

It is not uncommon that the long-term charts hide trading opportunities, which is the reason for zooming in on the medium-term time frame.

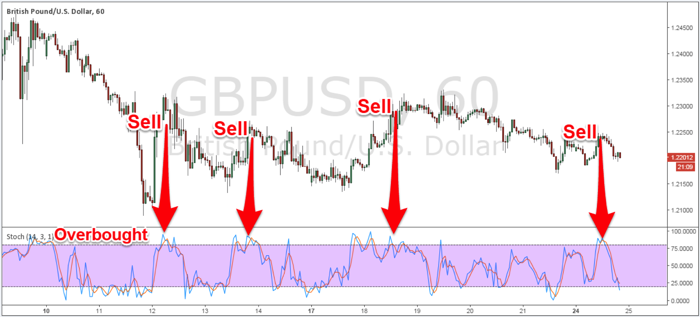

The medium and short-term time frames help us zoom in and spot trade opportunities.

Looking at the medium-time frame, we’re going to gauge the market momentum and possible overbought/oversold signals in the direction of the trend spotted on the higher time frame. If the overall trend is up, look for the market to turn from the oversold levels, and if the overall trend is down, look for the market to turn from overbought levels.

Figure 2: GBP/USD 1H Chart

In this step, we will be able to spot potentially profitable trades. However, to better time the market, we need to go one step forward.

The short-term time frame will be used to time the market and find the optimal entry levels in the direction of the trend. In simple terms, we use short time frames for pinpointing trade entries and exits.

Once the identified overbought or oversold level is determined using the medium-term time frame, we switch to the short time frame to enter a trade at the right time.

This is done by setting up a trigger to sell the currency pair (short) at “the break of support”, as we identified the trend to be bearish looking at the Long-time frame; and buy at the “break of resistance” if we’re in a bullish trend.

Figure 3: GBP/USD 15-Minute Chart

Multiple time frame analysis is a top-down approach to studying price action. Using Multiple time Frame Analysis, we can detect and validate market trends and time when to enter a trade.

Explore more resources that fellow traders find helpful! Check out these other guides to enhance your forex trading knowledge and skills. Whether you’re searching for the best brokers, educational material, or something more specific, we’ve got you covered.