Compare Forex Brokers!

Compare top Forex brokers side-by-side and find the best fit for your trading needs. Start your comparison now!

Momentum measures the rate of change in closing prices for a currency pair, a stock or commodity. It is often used to detect weakness or inherent strength in a pair. Importantly, it signals where potential reversal points are, or when trends are about to begin. Forex traders always look for changes in momentum as it makes it easy to better predict the volatility in the currency exchange market. A trend is the strongest when there are high momentum readings to the upside or the downside.

We often find lower readings of momentum at the beginning of a trend, as it hasn’t yet built up any significant momentum indicate its strength. Understanding the principle that momentum increases is key to understanding how to read momentum in the Forex market correctly. When we are in a strong trend, either bullish or bearish, momentum precedes price which makes momentum the leading indicator. Generally, you only want to take a signal from the momentum indicator when it is in line with the dominant trend. If the momentum is going in the opposite direction of the trend, it’s recommended not to make a trade. There are several indicators used to measure momentum.

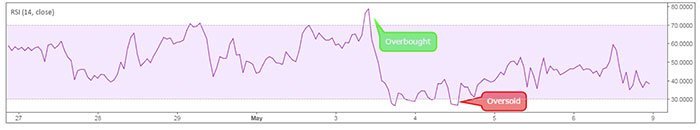

The RSI indicator (Figure 1) is one of the most used oscillators among professional FX traders as it tends to be more accurate. The RSI indicator oscillates between 0 and 100. It rarely reaches extreme levels and usually stays in the 20-80 range. When there is a momentum reading above 80, traders perceive this as being an overbought condition, and when there is a momentum reading below 20, this is seen as an oversold condition.

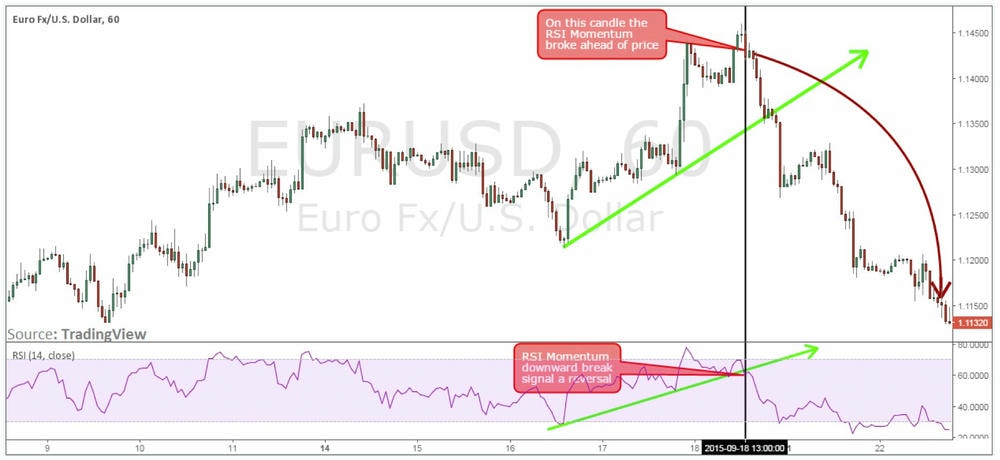

The overbought and oversold strategy is not a reliable one because the market can continue this behaviour for an extended period before reversing. As the momentum precedes price, traders must tread momentum readings in the same way as price action. When we see breaks in the trendlines for the momentum indicator, they often occur before the breaks in the price action. Think of momentum as a ball thrown up in the air. When you throw up a ball in the air, it has upward momentum. But when the ball stops, the momentum reverses because the upward acceleration has stopped. It is the same with price action on the Forex market. For the value of a currency pair to fall, the momentum must have already been falling ahead of the price.

In the example above, there was a strong trendline (TL) on the momentum indicator and strong upward movement in the price action. When that TL on the RSI indicator was broken, it was a warning sign that the trend is coming to an end, and that the market has started a significant reversal. Because momentum always precedes price, whenever we have a break in momentum, it is a warning sign that the market is losing steam and the prevailing trend is about to reverse.

The momentum RSI indicator is a leading indicator as it is straightforward to understand, and it is one of the few indicators out there which are as unique and compelling. With the RSI indicator, you can treat momentum like price action, which is easy to translate into trading opportunities. The RSI oscillator is useful for determining pivot points, and thus entry and exit points for trades.

Explore more resources that fellow traders find helpful! Check out these other guides to enhance your forex trading knowledge and skills. Whether you’re searching for the best brokers, educational material, or something more specific, we’ve got you covered.