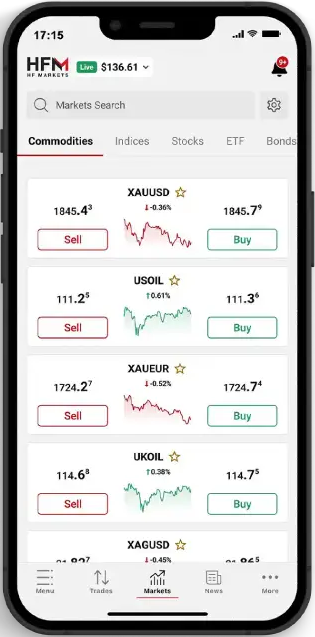

MetaTrader 5 (MT5) is the most recent version of the MetaTrader Forex trading platform and the first to have native multi-asset functionality for stocks, futures, and crypto. Traders will also be looking to use the expanded set of indicators and run improved MQL5 scripts to enable automated trading. The previous version of MetaTrader (MT4) is being gradually phased out, so it’s a good time to try out this new, more advanced trading platform.

Many traders are drawn to MT5 because of the wide range of CFDs to trade, but to find the best MT5 brokers, we also compared trading costs, execution speed and the number of Forex pairs available. For many beginners, MT5 will be their first trading platform, so we also tested the quality of the brokers’ technical customer support and the quality of their education. Last but not least, we made sure that all brokers on this list were fully regulated to ensure trader safety.

Trusted. Transparent. Tested.

For over a decade, we’ve set the standard in forex broker reviews—collecting thousands of data points yearly to deliver unbiased, expert-backed insights.

Skip the trial and error! Below, you’ll find the best forex brokers for Ugandan traders for 2026—thoroughly tested, verified, and ranked, so you can trade with confidence.