How a Forex Demo Account Works

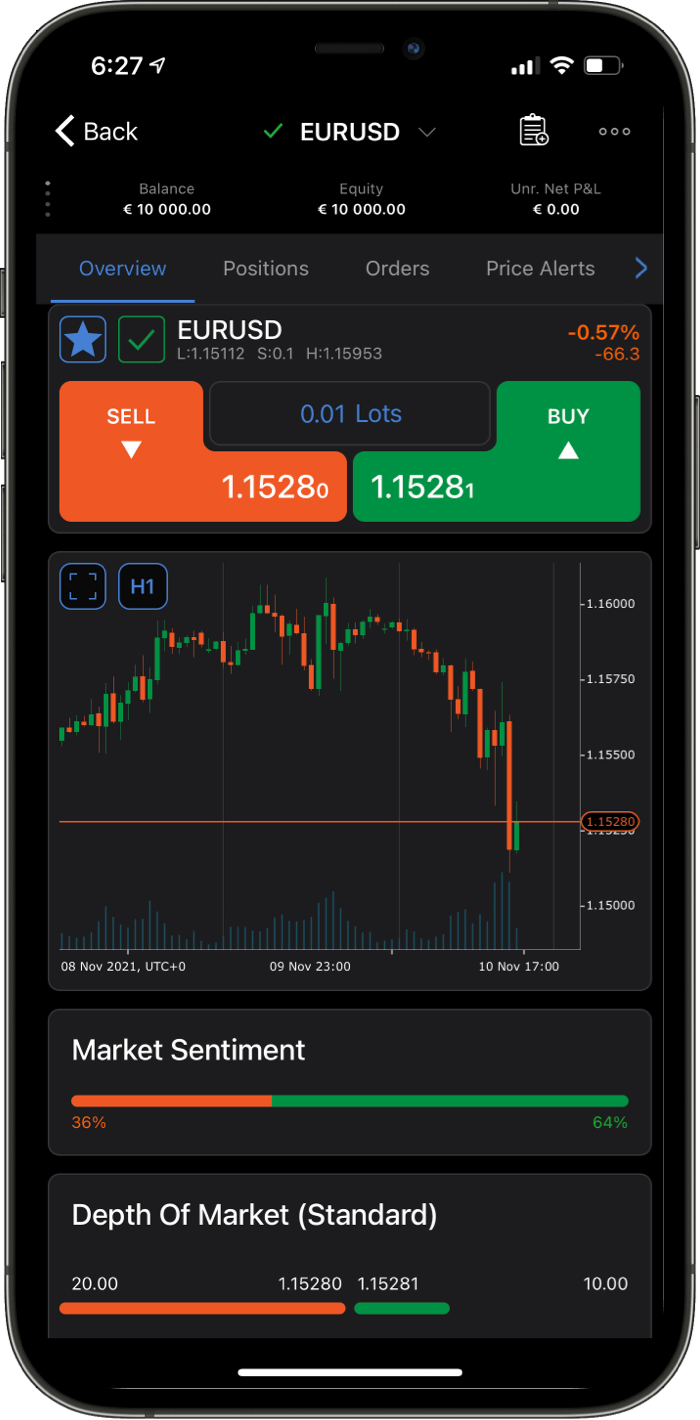

When you open a demo account, your broker gives you a balance of virtual money, usually between USD 10,000 and USD 100,000. You can use it to place trades, test strategies, and explore different order types in real time.

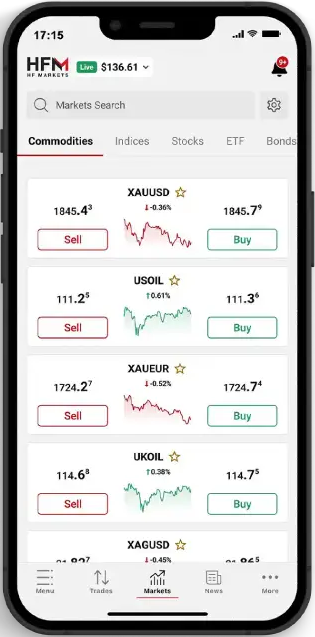

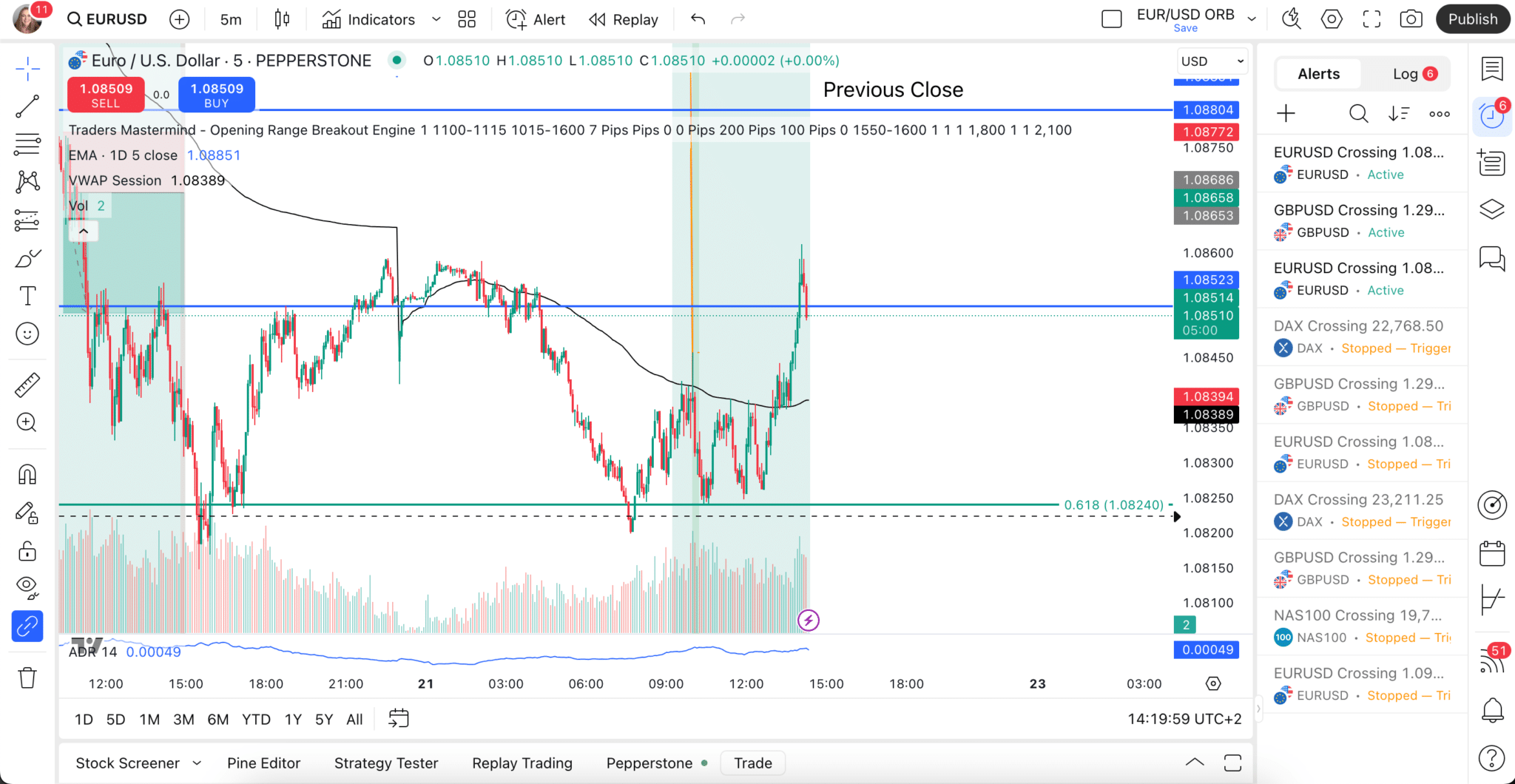

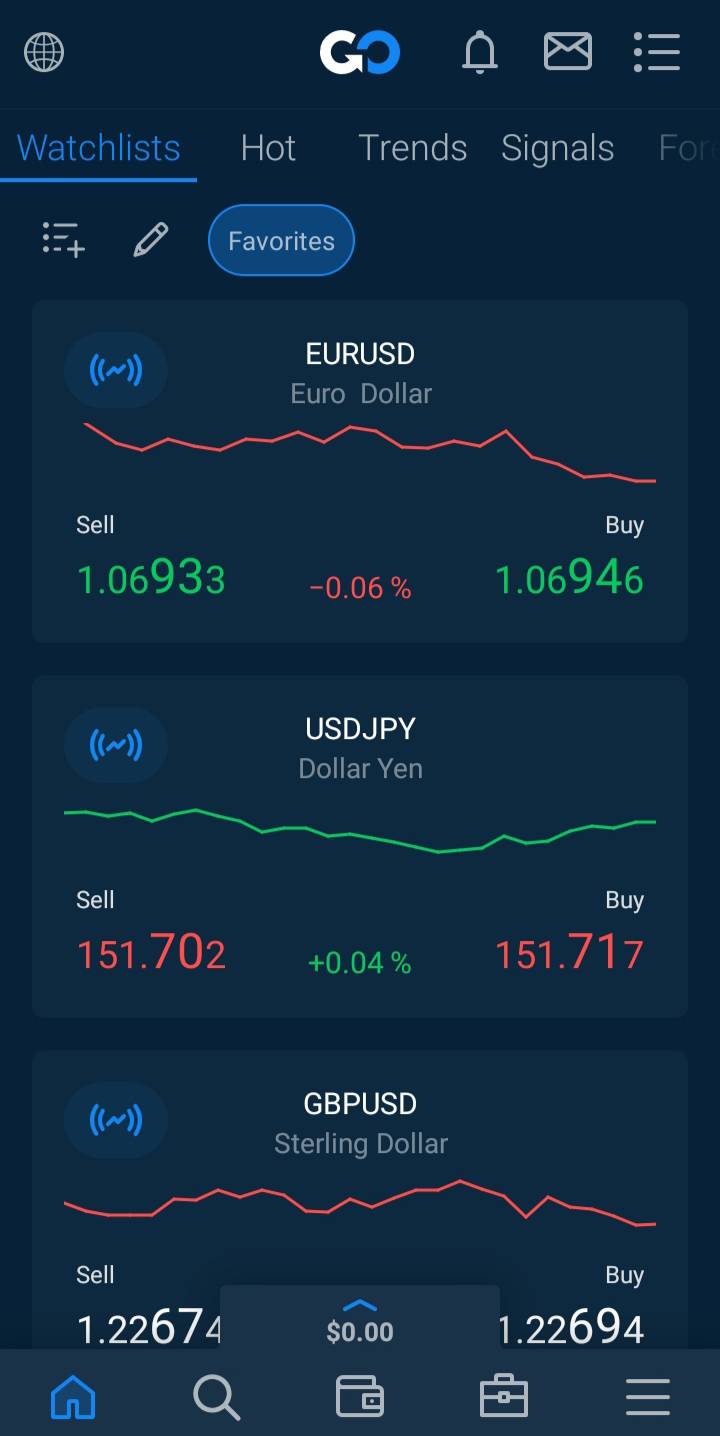

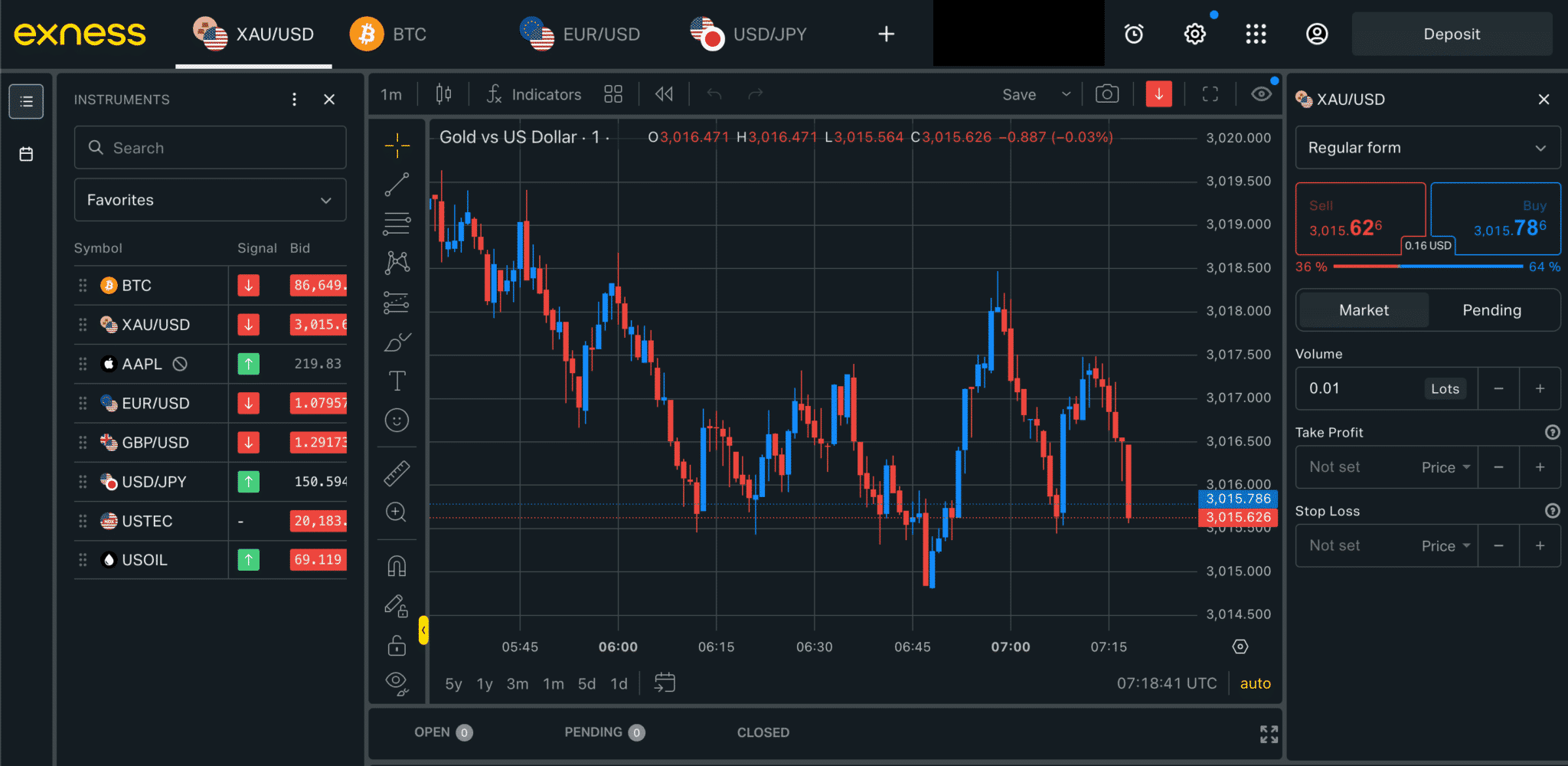

You’ll see real spreads, charts, and price movements—exactly as you would in a live account—but any profits or losses are simulated.

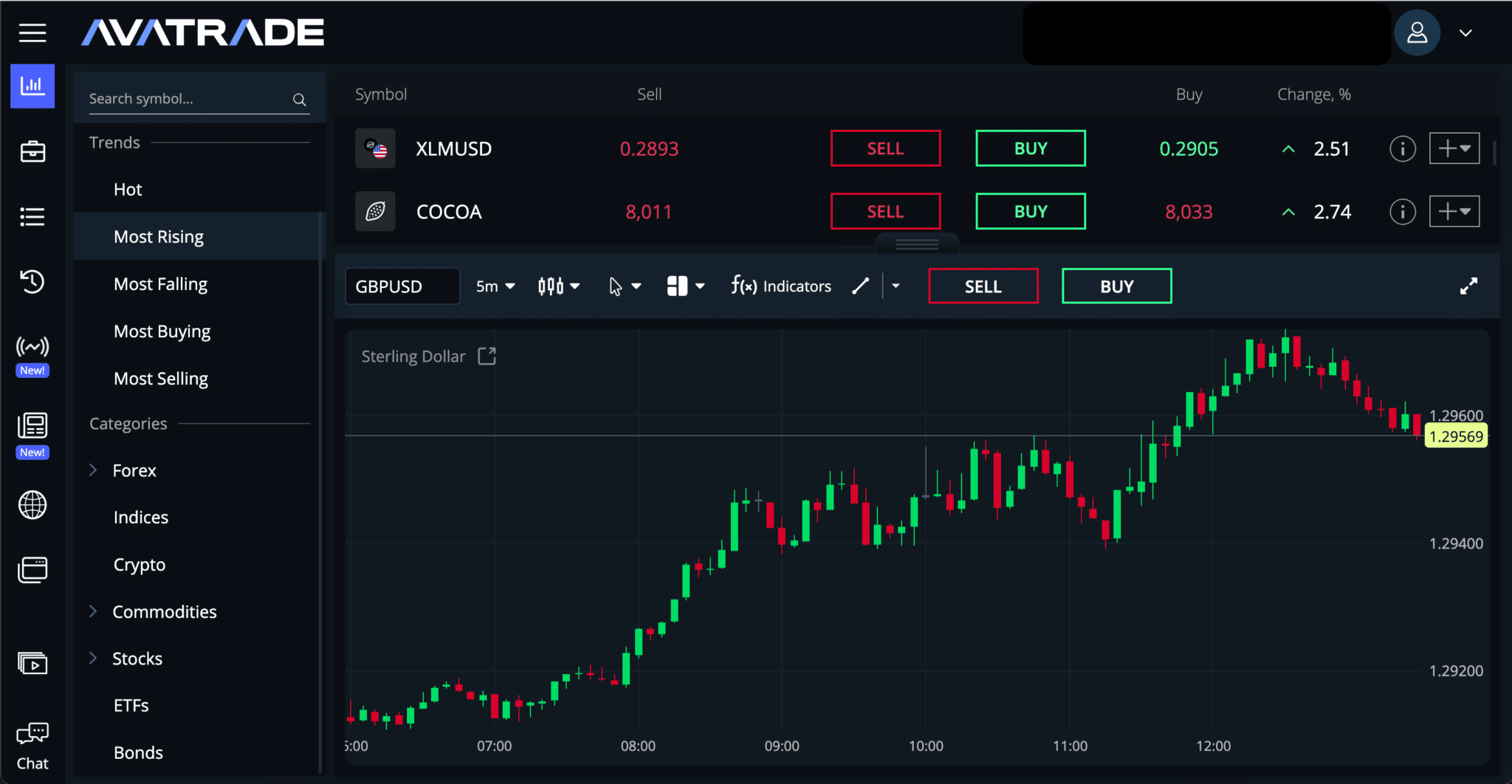

Demo accounts also use the same trading platforms as live accounts—like MT4, MT5, cTrader, and TradingView—so you can learn their tools and layouts without risk.

While demo trading feels realistic, it’s not identical to live trading. Execution is often faster, slippage is minimal, and the emotional pressure is missing. But as a learning environment, it’s the most accurate simulation available.

Why a Forex Demo Account Is Important

A demo account is an essential step for every trader. It lets you learn the markets, practise safely, and build confidence before trading real money.

1. Learn the Basics Safely

Demo accounts show you how Forex trading works—how orders, spreads, and leverage affect results—without financial risk. It’s the fastest way to build practical understanding.

2. Build Confidence and Control

Trading can be emotional. Practising in a demo environment helps you stay calm and disciplined during wins and losses, preparing you for live trading.

3. Test and Improve Strategies

You can try new ideas and adjust your approach under real market conditions. The feedback you get in demo trading is invaluable for refining your strategy.

4. Master Your Trading Platform

Each platform is different. A demo account lets you explore charting tools, indicators, and order types until you’re comfortable executing trades efficiently.

5. Experience Real Market Conditions

Demo accounts use live market data, so you can learn how spreads, volatility, and price movements behave in real time—skills that make a huge difference later on.

Pros and Cons of Using a Forex Demo Account

Pros

- Let’s you learn trading safely and risk-free.

- Builds confidence, discipline, and technical skill.

- Allows strategy testing under real market conditions.

- Familiarises you with trading platforms before using real funds.

Cons

- Emotional impact is limited compared to real trading.

- Execution speed and slippage may differ from live accounts.

- Overconfidence or unrealistic expectations can form if trading isn’t treated seriously.

How to Use a Demo Account Effectively

A Forex demo account is most useful when treated as real preparation, not just a simulation. These tips will help you build the right habits and confidence before trading live.

1. Trade as if It’s Real

Treat your demo balance as if it were your own money. Use realistic position sizes, apply stop losses, and avoid unnecessary risks. This helps you develop discipline and accurate expectations about trading performance.

2. Combine Practice With Education

Use your demo account alongside FxScouts’ Forex Education Centre. Study technical and fundamental analysis, learn how indicators work, and apply what you learn immediately in the demo environment.

3. Keep a Trading Journal

Document each trade, including your reasons for entering and exiting. Reviewing your results helps you identify patterns, refine strategies, and build consistency over time.

4. Develop a Trading Strategy

Experiment with different approaches—trend-following, swing trading, or scalping—and see which suits your goals, temperament, and time availability. The more you test, the more refined and confident your trading plan will become.

5. Know When You’re Ready to Go Live

Use your demo account until you can trade profitably and consistently for several weeks under different market conditions. That’s a reliable sign that you’ve built both the skill and emotional discipline to handle real money.