Why cTrader Stands Out

cTrader’s appeal comes from its combination of speed, transparency, and modern design. All orders are executed on Spotware’s independent servers, which removes the possibility of broker interference and helps ensure accurate pricing.

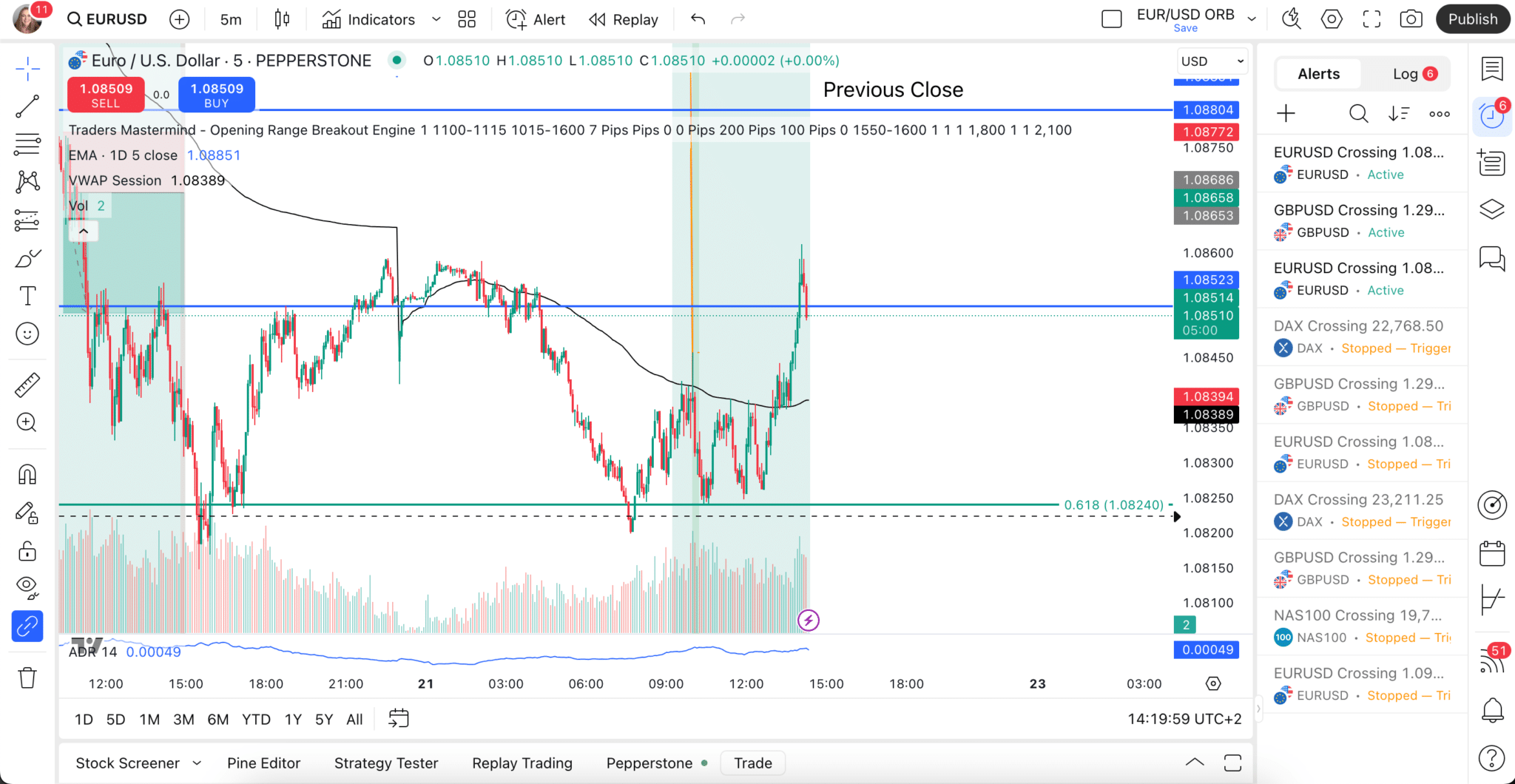

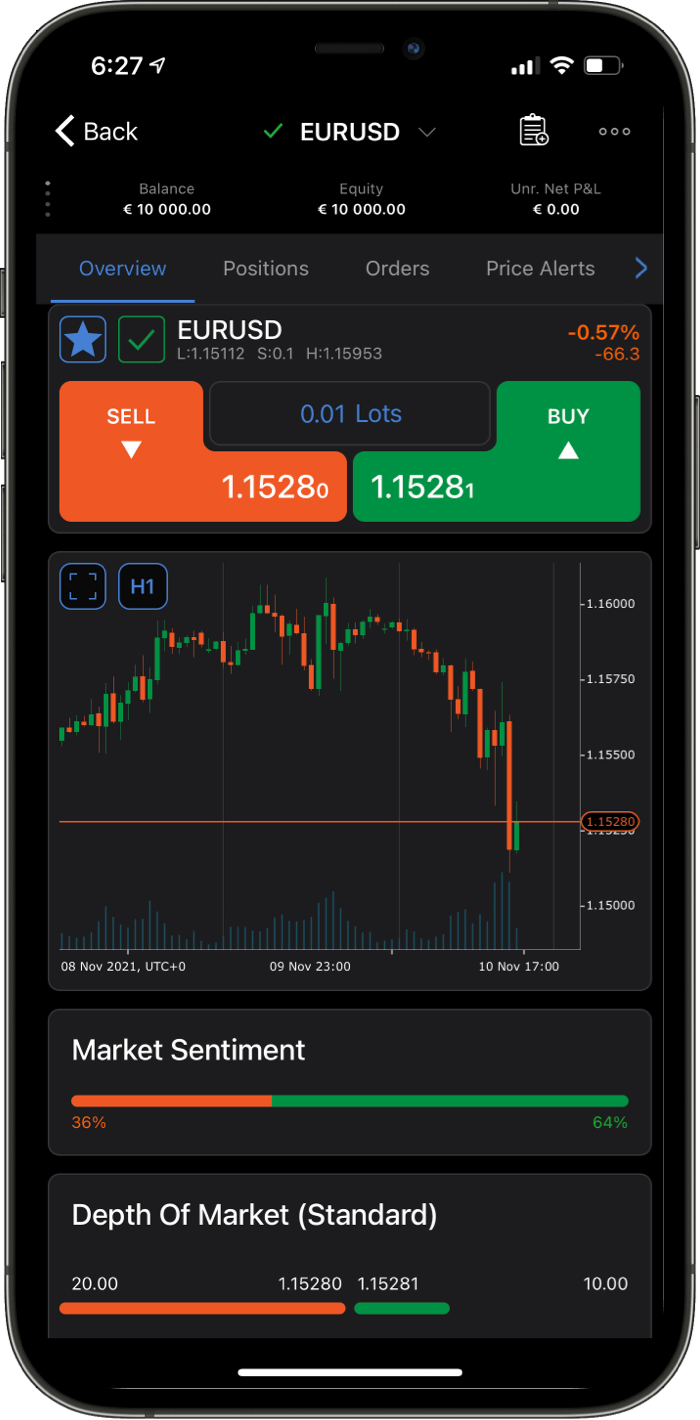

Server-side processing keeps orders responsive, even when your trading terminal is offline. The interface is clean and intuitive, while the charting package includes multiple layouts, more than 50 indicators, and live depth-of-market data for a clear view of market liquidity.

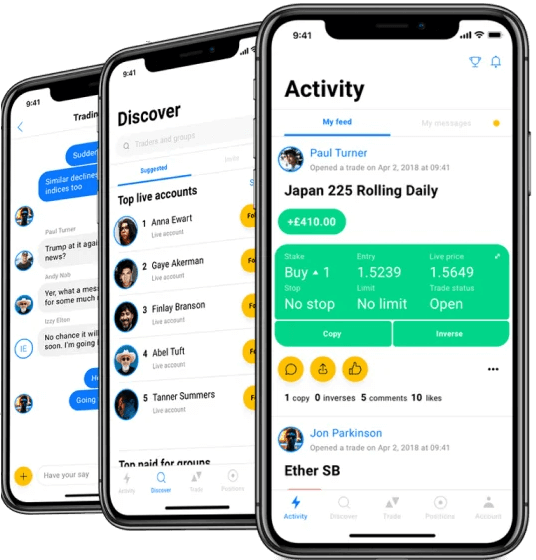

For advanced traders, cTrader Automate supports algorithmic strategies written in C#, and cTrader Copy enables transparent social trading directly within the platform. These features work consistently across desktop, web, and mobile, creating a fast, reliable environment trusted by traders worldwide.

cTrader Platform Versions

cTrader delivers a unified trading experience across desktop, web, and mobile platforms, each designed for seamless synchronisation.

Desktop:

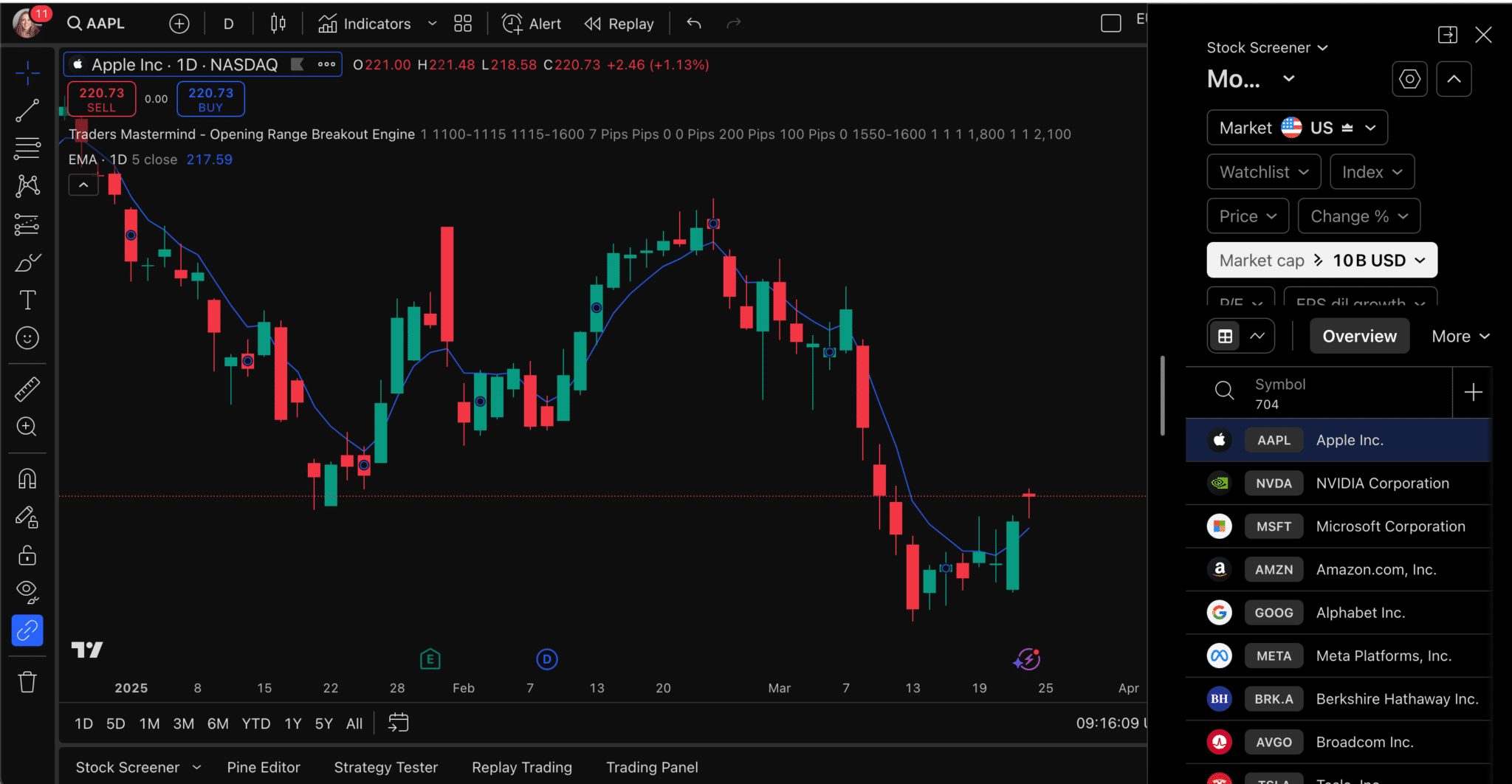

The most feature-rich version, offering advanced chart customisation, tick-data backtesting, and full support for algorithmic trading via cTrader Automate. Best for detailed analysis and strategy development.

Web:

A near-identical experience accessible through any modern browser, ideal for traders who need quick access without installing software.

Mobile:

Available on iOS and Android, the app includes 26 timeframes, gesture-based charting, and full trade management features so you can monitor or adjust positions from anywhere.

All versions are connected through a single cTrader ID (cTID), giving you one secure login for all demo and live accounts across supported brokers.

cTrader vs MetaTrader

Both cTrader and MetaTrader (MT4/MT5)are leading trading platforms, but they suit different trading styles. MetaTrader offers wider broker support and a larger community, while cTrader focuses on transparency, execution quality, and a more modern user experience.

| Feature |

cTrader

|

MetaTrader 4 / 5 |

|

Execution Model

|

True ECN / No dealing desk

|

Broker-dependent

|

|

Charting

|

Advanced, customisable, modern interface

|

Functional but dated

|

|

Algorithmic Trading

|

C# via cTrader Automate

|

MQL4 / MQL5 |

|

Copy Trading

|

Built-in (cTrader Copy)

|

External

(MQL Signals)

|

|

Depth of Market

|

Full multi-level view

|

Limited

|

|

Broker Control

|

Independent (Spotware-hosted)

|

Broker-managed

|

MetaTrader remains the more widely accessible platform, but cTrader delivers greater fairness, execution speed, and precision. For traders who prefer a cleaner interface and institutional-style conditions, cTrader offers a more modern and transparent trading experience.

Strengths and Limitations

cTrader’s design gives it several advantages over most retail trading platforms, though there are a few limitations to keep in mind.

Strengths

- True ECN transparency: Orders are processed without dealing-desk intervention for fair, conflict-free execution.

- Server-side order control: Stop-losses and trailing stops remain active, even when the platform is offline.

- Advanced charting and analysis: Highly customisable charts with 50+ indicators and multiple layouts.

- Integrated automation and copy trading: Algorithmic trading via cTrader Automate and social trading through cTrader Copy.

- Cross-device consistency: Desktop, web, and mobile versions sync fully through a single cTrader ID.

Limitations

- Limited broker support: Fewer brokers offer cTrader compared to MetaTrader.

- Smaller marketplace: Fewer third-party tools and indicators than the MetaTrader ecosystem.

- Occasional update delays: Platform updates may slow startup times briefly, though they typically add useful improvements.