Trading Tools

Tickmill offers a number of excellent trading tools, including Autochartist, Myfxbook, PelicanTrading, a VPS service, an advanced trading toolkit, and a one-click trading plugin. Autochartist is free of charge for all registered users, while other third-party tools such as myfxbook, Pelican Trading, and VPS hosting incur an extra cost on the part of the trader.

AutoChartist

AutoChartist is a third-party automated chart analysis tool that scans the markets for volatility and notifies traders of relevant trading opportunities. Since it integrates into MT4, information is available inside the trading view and simplifies the platform while providing additional analysis. Autochartist is a common technical analysis tool among traders, so training videos are easy to find online. Autochartist is one of the best analytics tools on the market, and Tickmill does well to provide this service to its clients. Tickmill offers AutoChartist free of charge to all live and demo account holders.

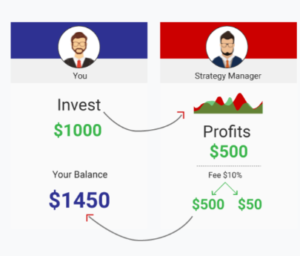

Myfxbook

Another common third-party trading tool available on Tickmill is Myfxbook AutoTrade, a cross-broker social trading platform that allows for copy trading without additional software. Myfxbook is available at an extra cost, and traders will have to contact myfxbook directly to find out more. Myfxbook is lauded as one of the best social trading platforms available.

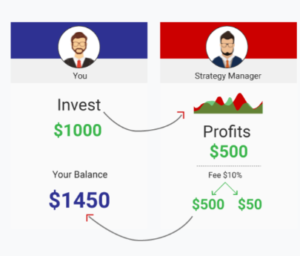

Pelican Trading

Like Myfxbook Auto Trade, Pelican is an innovative all-in-one mobile auto-copying application that allows traders to follow and copy trades from other successful traders. Pelican has a user-friendly interface that provides a platform to learn from and chat to other traders and mentors. Users can also track and analyse the performance of other traders. This platform is ideal for beginners starting out in the trading space. Again, traders will have to contact Pelican directly to find out about the costs associated with using the service.

VPS Service

Tickmill VPS has partnered with BeeksFX to provide a discounted VPS service to clients. As one of the largest Forex VPS providers, BeeksFX gives users access to very low latency networks and expert advisors.

Tickmill clients are entitled to the following exclusive benefits with BeeksFX:

- 20% discount on all packages.

- Quick setup and a 24/7 live chat and email support.

- Negligible latency due to VPS servers’ adjacent location to Tickmill.

- 100% uptime guarantee.

No shared resources, and increased control.

Advanced Trader Toolkit

Free to all Tickmill clients, the Advanced Trader Toolkit gives traders access to institutional quality technology, including advanced trading tools, user-configurable news and information, and trade analysis. It also includes an array of sophisticated alarms and messaging systems, and live sentiment and correlation tracking. This tool is appropriate for more experienced traders refining their trading strategies. Some of tools in the package include:

- Trade Terminal: A feature-rich professional trade execution and analysis tool, providing several trading features and order controls that are not included in MT4 or MT5.

- Connect: A customisable news feed aggregator and interactive economic calendar.

- Mini Terminal: Tailored to the MT4, manage your execution with context in a specific trading chart.

- Correlation Matrix and Correlation Trader: These tools work together to show correlations between pairs of trading symbols. It functions with any symbols available in the trading platform, allowing a calculation of the correlation between multiple asset classes against Forex. The Correlation Trader will then allow for detailed inspection of the correlation between any two instruments.

- Sentiment Trader: Allows traders to feel the markets out with real-time long and short positioning data, historic sentiment, and a dashboard for multiple instrument sentiment analysis.

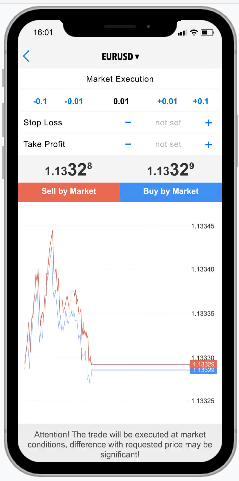

One-Click Trading

The One-Click Trading MT4 Expert Advisor (EA) is designed to make common trading mechanisms more accessible, facilitating trading and removing unnecessary navigation between windows and charts. This EA does not overly simplify MT4, but it does make trading on the platform less complicated.