Selecting a reliable and trustworthy Forex broker is one of the most important decisions a trader can make. Whether you’re new to Forex trading or are an experienced trader, you need a broker that provides competitive pricing, a stable platform, and a secure trading environment. This is why we are committed to delivering thorough, transparent, and unbiased reviews to help you make informed decisions.

Since 2011, we have been writing transparent, trustworthy reviews that you can rely on. We cover every aspect of a broker's service—from platform performance and cost to regulatory status and customer support — and with regular updates and integration of user feedback, we guarantee access to the latest and most relevant information.

Our review process is based on our core editorial values of independence, honesty, and impartiality and our Broker Score and Trust Rating system allows you to assess a broker’s overall quality at a glance. Our mission is to give you the tools and knowledge to choose the best Forex broker for your trading success.

Find the Best Forex Brokers in Uganda

Proprietary Broker Score and Trust Rating System

At FxScouts, we employ the following types of scoring:

Yes/No Scoring

Our Yes/No scoring is based on over 100 proprietary variables that inform our final ratings and rankings. Points are assigned for each “Yes” answer, with varying weights depending on the variable’s significance. The final “Yes/No” score, or the broker’s Variable Score, is the total points earned divided by the total points possible.

Opinion Scoring

Opinion scoring complements Yes/No scoring by addressing important aspects that can’t be quantified. Scores range from 1 to 10, with half points used for more granular scoring.

Quantitative Scoring

Our proprietary quantitative scoring system utilises a set of quantifiable metrics, such as trading fees, withdrawal times, number of trading instruments, platform availability, and customer service response times. Each metric is assigned a weight according to its importance. A metric deemed to be more critical is assigned a higher weight. This ensures that the score reflects the priorities of the evaluation process.

Data is collected through various methods, including direct observation, market research, data feeds, or directly from brokers. Once collected, the data is filtered—e.g. normalising scores to common scales and converting raw data into a score using algorithms—and assigned appropriate weights, producing an overall score for each broker.

Finally, the scores are analysed, compared, and reported in a format that provides useful information to the end user.

Get a head start with our Best Forex Brokers for Beginners

Building Trust: Research-Based and Fact-Checked By Industry Experts

We hold editorial integrity above all else. It shapes our assessments and differentiate us as a reliable and trusted source for Forex broker reviews.

1️⃣ Stronger Transparency – We open accounts with brokers to assess real-time trading conditions rather than rely solely on data provided by the brokers themselves.

2️⃣ Greater Expertise & Credibility – Our team includes financial experts and experienced traders—not just content writers.

3️⃣ No Paid Scores or Ratings – Unlike many competitors, we do not allow brokers to pay for higher review scores or ratings.

4️⃣ Regulatory Verification Beyond Competitors – While others check only broker licenses, we cross-reference broker compliance history with regulatory databases.

5️⃣ More Comprehensive Testing Criteria – Most sites only focus on spreads and regulation. We evaluate key factors like execution speed, slippage, hidden fees, customer support quality, and the availability of educational resources.

6️⃣ Validate Broker Authenticity - We thoroughly verify brokers to confirm their legitimacy and ensure they operate as they claim. This involves checking domain accuracy to prevent scams or impersonators from misleading traders.

7️⃣ Scam Broker Warnings—If a broker is a scam, we say so. We check for suspicious activity and signs that the broker might be a scammer.

See our guide to the Best MetaTrader 5 Brokers

Broker Score: The Performance Rating

The Broker Score reflects the overall quality and performance of a Forex broker.

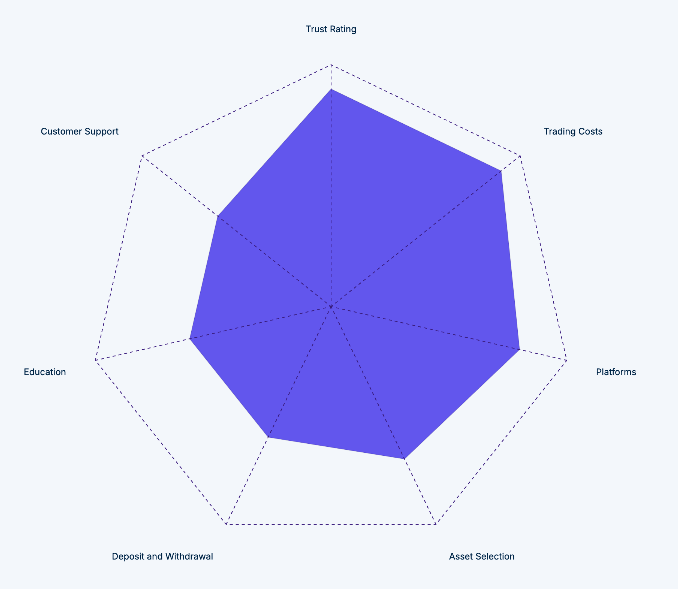

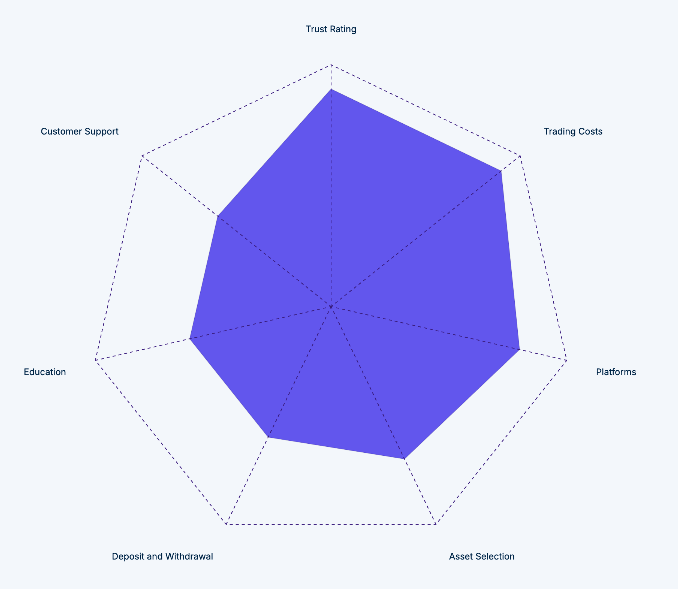

Brokers are scored in seven different areas, with each area awarded up to a maximum of 5.00. The final score is calculated by weighting each area according to its importance in the review process.

A higher Broker Score indicates strong performance by the broker, while a lower score suggests areas that may need improvement.

- High Ratings (4 - 5): Brokers in this range are considered top-tier—they excel in all areas, and go the extra mile to ensure they exceed expectations.

- Medium Ratings (3 - 4): Brokers with medium ratings perform decently in various areas but may need to improve in key areas.

- Low Ratings (Below 3): Brokers in this category may have issues with many or all categories, making them less suitable for traders seeking a reliable, secure trading environment.

Trade on-the-go with the Best Forex Trading Apps

What We Test and Why It Matters

We evaluate every aspect of a broker’s service—from trading conditions and platform performance to order execution, asset selection, deposits, educational resources and market research, and customer support. By testing each category in detail, we deliver transparent, reliable insights that empower you to make well-informed trading decisions.

| Categories | Why It Matters | Weight |

| Regulation, Trust & Security | We review compliance with regulatory standards with top-tier regulators, including enforcing safeguards like negative balance protection, leverage limits, segregated accounts, two-factor authentication and advanced encryption. We also assess a broker's trustworthiness by evaluating its integrity, transparency, and reliability in handling funds while meeting ethical standards. | 20% |

| Trading Conditions | We review spreads, fees, and leverage across different account types. We assess pricing structures and transparency so you know exactly what you're paying. We also assess order execution for slippage, especially during volatile market conditions. Fast, accurate execution can make a difference between profits and losses. | 20% |

| Platform Performance | We assess which trading platforms the broker offers. Brokers with more trading platforms score higher. We test the usability, stability, and speed of each trading platform and the mobile app experience to ensure it’s as smooth and feature-rich as the desktop version. | 17.5% |

| Deposit & Withdrawals | We evaluate the variety of payment methods available and the speed, transparency, and cost of deposits and withdrawals. We test all payment types, from credit cards and bank transfers to e-wallets and cryptocurrency options. | 10% |

| Customer Support | Our team tests all the available support channels, including live chat, email, and phone support, for responsiveness, helpfulness and knowledgeability. We also look at the customer support availability. | 10.% |

| Asset Selection | We compare the variety and number of trading instruments each broker offers. A diverse range of trading instruments allows traders to diversify portfolios, hedge positions, and implement varied strategies across multiple markets. | 12.5% |

| Education | We review the quality of the broker's educational content, such as tutorials, market analysis, and webinars. A good broker should provide traders of all levels with the resources they need to succeed. | 10% |

Getting Down to Details

Regulation, Trust and Security

- Regulatory Compliance: We assess each broker's regulatory status to ensure they adhere to the laws set by financial authorities. Not all authorities provide the same protection for traders. Brokers with licenses from top regulators, like the FCA, ASIC, and CySEC, tend to score higher due to their rigorous compliance standards.

- Protection & Security: Top-tier regulators require brokers to implement protections such as negative balance protection, leverage limits, and segregated accounts to ensure compliance and accountability. Additional measures like two-factor authentication and advanced encryption further secure clients' funds and personal information.

- Financial Transparency: We evaluate brokers on fee transparency, account security, and processing times. Brokers that provide detailed fee breakdowns, ensure client fund protection through segregated accounts and insurance, and offer swift withdrawal processing earn higher ratings.

- User Feedback and Reputation: We analyse real user feedback to gauge customer satisfaction, awarding brokers with positive reputations and fewer complaints with higher trust scores. We also factor in independent audits and public disclosure of audit reports, with greater transparency leading to higher ratings.

- Dispute Resolution & Ethical Practices: We assess brokers on how effectively they handle disputes, with higher ratings for those who are responsive and transparent in resolving customer issues. We also evaluate their ethical practices by examining adherence to fair trading standards and avoidance of manipulative behaviours like market manipulation or hidden fees.

Trading Conditions

- Spreads & Commissions: A key factor in evaluating trading conditions is the broker's spread on major currency pairs. We also look at whether it charges commissions on trades. Brokers offering tight spreads and low commissions typically receive higher scores in this category.

- Leverage & Margin: Leverage is an integral part of Forex trading but also presents a risk for both experienced and beginner traders. We examine the leverage limitations (if any) placed by regulatory bodies, their suitability for various trading styles, and the risks they might pose. We also review margin requirements to ensure they align with regulatory limits, such as the UK's FCA guidelines.

- Execution Speed & Slippage: How quickly an order is executed is a crucial factor. Brokers that provide consistent, fast, and accurate order execution with minimal slippage earn higher ratings.

- Minimum Deposits: How much do you need to deposit before you can start trading? The lower the required minimum deposit, the easier and more accessible trading becomes.

- Lot Sizes: The size of the lots brokers allow traders to use can influence trading risk. The bigger the lots, the more risky it becomes. Brokers who offer micro lots allow traders to manage their risk better.

Platform Options, Usability and Features

- Platform Variety: More trading platform options offer greater flexibility and accessibility to a broader range of traders with different preferences. It allows traders to choose the platform that best suits their needs. Brokers that offer a great variety of industry-leading options like MetaTrader 4 & 5, cTrader and TradingView score higher.

- User Interface & Navigation: The ease of use of a broker's platform is paramount. We assess the intuitive design, speed, and user experience of the platform to ensure that it caters to both beginner and advanced traders.

- Advanced Features: We look for important features like charting tools, automated trading options, and technical analysis tools. Brokers that offer powerful, customisable features are rated higher for their ability to meet diverse trader needs.

- Mobile Platform: Mobile experience matters. We assess the mobile app’s usability, reliability, performance, and device compatibility so that traders can trade effectively on the go. Brokers that offer fast, easy-to-use native, cross-platform apps score higher.

- Variety of Devices: We test platforms using a variety of popular devices, such as mobile phones, tablets, laptops, and desktop computers. Since not everyone has the latest devices, we test on both older and newer models to determine the overall user experience.

Deposit and Withdrawal Options

- Payment Methods: We evaluate how easy it is to make deposits and withdrawals. We check if the broker provides popular, industry-standard local payment options like credit cards, bank transfers, e-wallets, and cryptocurrencies. All these factors contribute to the score. The easier the trader can fund and withdraw from their account, the higher the score.

- Transaction Fees & Speed: We test the speed of transactions and any associated fees. Brokers that process deposits and withdrawals quickly with minimal fees will score higher in this category.

Customer Support

- Response Time & Availability: We assess how quickly and effectively the broker's support team responds. A responsive and professional customer support team available 24/7 across different time zones earns a higher rating.

- Helpfulness & Expertise: We evaluate the knowledge and helpfulness of the support agents. Brokers that provide in-depth support, such as solutions to complex technical issues, are rated more highly.

Asset Selection

- Range of Assets Offered: A diverse selection of assets allows traders to explore different markets and diversify their portfolios. We evaluate the variety of instruments available, including Forex pairs, commodities, stocks, cryptocurrencies, and indices, to ensure the broker provides sufficient options for all types of traders.

- Asset Availability and Liquidity: We assess the liquidity of the available assets and their accessibility to popular and emerging markets. Brokers that offer a broad range of liquid assets across various sectors and regions will score higher in this category.

Educational Resources

- Quality of Content: We examine the range and quality of educational resources, such as trading guides, webinars, video tutorials, and market insights.

- Brokers offering comprehensive educational materials for traders at various experience levels are rated higher.

- User Engagement: Brokers that provide engaging, interactive content like live workshops, webinars, and community forums earn better ratings.

Learn from experienced traders with the Best Copy Trading Brokers

Who Writes Our Reviews? Meet Our Team

Our team of dedicated reviewers have spent years immersed in the Forex industry, testing trading platforms, analysing market trends, and evaluating CFD/Forex brokers globally.

Alison Heyerdahl, Senior Market Analyst – Over 7 years of hands-on Forex trading experience, specialising in trading platforms and broker technology.

Stefan de Clerk, Trading Researcher – Leads our in-house testing team and evaluates spreads, execution speeds, and platform usability.

Chris Cammack, Broker Review Specialist – Focuses on trading conditions, fees, and regulatory compliance across global brokers.

Ida Hermansen, Crypto and Blockchain Specialist - Evaluates crypto trading, user experience and other online services.

Industry Recognition: FxScouts Awards

Our unique FxScouts Forex Broker Awards are data-driven, relying on rigorous analysis and carefully considered expert opinions. We celebrate excellence in diverse aspects of Forex trading, from trading conditions and customer support to platform functionality and educational resources.

Our awards act as a gold standard in the Forex industry, championing brokers who exceed industry standards and elevate the trading experience. Explore the categories and discover the brokers who set benchmarks for the Forex trading world.

The Forex Broker Awards categories include:

- Broker of the Year

- Best Trading Conditions

- Best Trading Tools

- Best Trading Innovation

- Best Customer Support

- Best Trading for Beginners

- Best Trading Education

- Best Proprietary Platform

Discover our most popular guides:

FAQs

What is the FxScouts review process?

We rigorously test brokers on key factors such as trading conditions, platform usability, fees, customer support, and regulation to ensure accurate, impartial reviews.

What factors are considered when calculating the Broker Score?

The Broker Score is based on factors such as spreads, leverage, platform performance, customer support, and regulation, providing a comprehensive rating of a broker’s overall quality.

What is the Trust Rating?

The Trust Rating measures a broker’s transparency, regulatory compliance, and ethical business practices, reflecting how much traders can trust the broker.

How often are reviews updated?

We regularly update our reviews to reflect changes in broker offerings, platform updates, and user feedback.

How do you evaluate a broker’s platform?

We assess the platform’s usability, speed, stability, and features, including mobile app performance and compatibility, and advanced trading tools.

Do you consider user feedback in your reviews?

Yes, we incorporate user feedback from forums and reviews to ensure our assessments are up-to-date and reflect real-world experiences.

How do you assess a broker’s regulation?

We assess brokers' regulatory status with the FCA (UK), ASIC (Australia), and CySEC (Cyprus), ensuring they comply with top-tier industry standards for security and fairness.

Why is educational content important in your reviews?

We evaluate the availability and quality of educational resources brokers offer, as they are essential for helping traders enhance their skills.

Can brokers influence your reviews?

NO, our reviews are completely unbiased, based solely on independent testing and analysis, without external influence.

Do you charge brokers for reviews?

NO, brokers are not charged for reviews. We do not allow any payments to influence the outcome of our assessments.

Can traders contribute to the review process?

Yes, traders can share their experiences and feedback, which we use to enhance our reviews and keep them up to date.

Do you test mobile apps as part of your review process?

Yes, we test brokers' mobile apps to ensure they offer a smooth, functional experience for traders who prefer trading on the go.

How do you assess a broker’s customer support?

We test customer support by contacting brokers through multiple channels (live chat, email, and phone) to assess response times, professionalism, and problem-solving capabilities.

What role does broker transparency play in your review process?

Transparency is key; we ensure brokers disclose fees, commissions, and terms clearly to provide traders with the information needed to make informed decisions.

How do you ensure the accuracy of your reviews?

We combine hands-on testing, expert analysis, and real-world user feedback, continuously updating reviews to ensure they reflect the most current information about brokers.